Dodge County Property Tax Records and Assessment Lookup

Dodge County is in central Georgia. Eastman serves as the county seat. The county offers online property tax records. Residents can search these records anytime. The Dodge County Tax Assessor maintains the data. The county uses QPublic.net for access. This system helps owners check values. Buyers can research properties too. Records are open to the public. Georgia law ensures fair access. The office is in Eastman. Staff help with all questions.

Dodge County Property Tax Quick Facts

How to Search Dodge County Property Tax Records

Dodge County uses QPublic.net for online searches. This tool is free to use. You can search at any time. No account is required. The database is open to everyone. Results show up in seconds.

Visit qpublic.net/ga/dodge/ to begin. You may search by owner name. Address searches work well too. Parcel numbers give exact results. Try different spellings if needed. The system checks all fields.

The online records display key facts. You will see assessed value. Land and building values are split. Acreage is shown. Structure details appear. Year built is listed. Square footage is included. Tax district info shows too.

Maps are available online. You can view property lines. Aerial photos help you find land. Nearby parcels are shown. This aids with comparisons. Sales in the area appear. Use this data for value checks.

Eastman is the heart of Dodge County. The tax office sits near downtown. You can visit in person. Staff can help with searches. They explain the records too. Bring your property details when you visit.

Dodge County Tax Assessor Office

The Dodge County Tax Assessor sets property values each year. Georgia law calls for fair market value. The assessed value equals 40% of market value. A chief appraiser runs the office. Staff review sales data often. They track trends across the county.

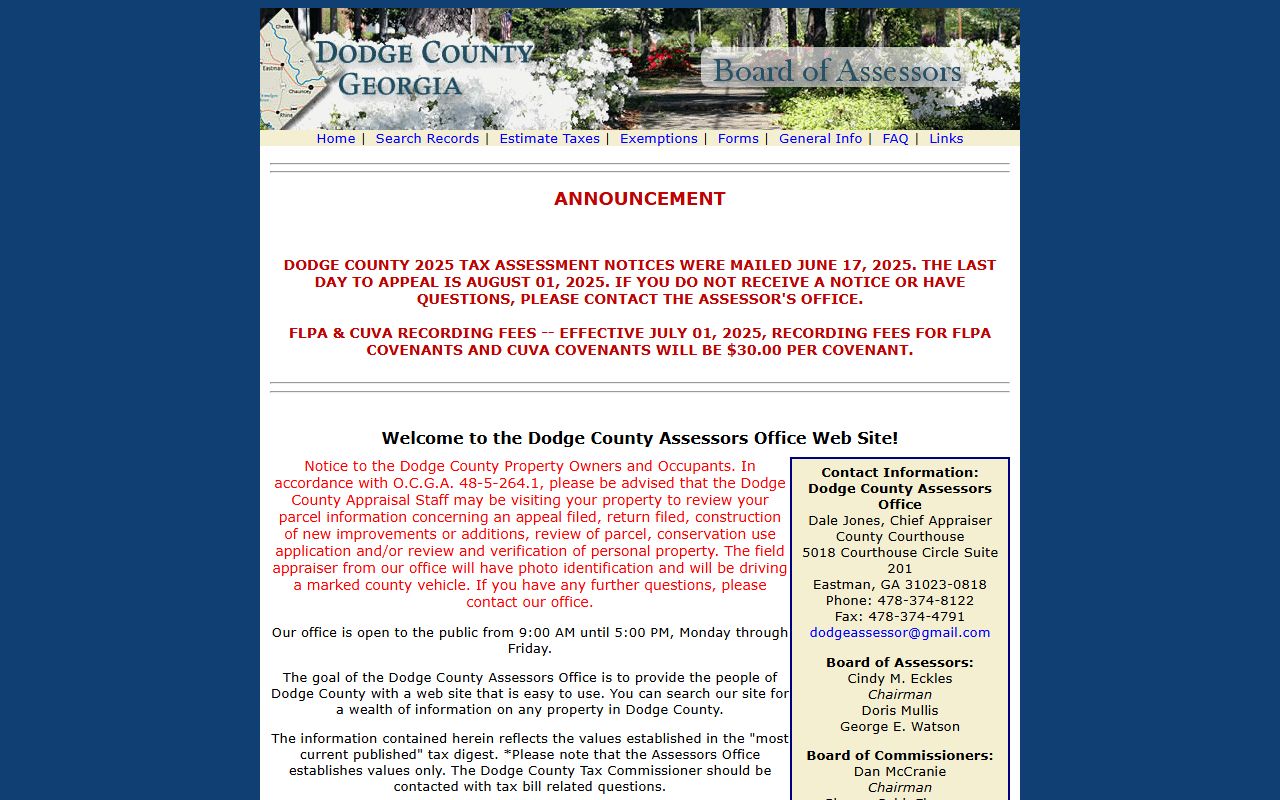

Assessment notices go out in spring. These show your value for the next tax year. Read your notice with care. It lists your appeal rights. You have 45 days to file an appeal. The deadline is strict. Late appeals will not be heard.

| Office Address |

Dodge County Tax Assessor 5018 Courthouse Circle Eastman, GA 31023 Phone: (478) 374-8122 |

|---|---|

| Hours | Monday - Friday, 8:00 a.m. - 5:00 p.m. |

| Website | qpublic.net/ga/dodge/ |

| Property Search | qpublic.net/ga/dodge/ |

The Tax Assessor office offers many services. Staff can explain your value. They provide sales data for your area. You can get copies of records. The office handles homestead forms too. These can lower your tax bill.

Call the office for help. The staff are friendly. They can guide you through appeals. You may visit in person too. Bring your assessment notice. Write down your questions first.

Dodge County Tax Commissioner Information

The Dodge County Tax Commissioner handles tax bills and collections. This office mails bills to all owners. They take payments and give receipts. The Tax Commissioner manages past due accounts. They handle tax sales when needed.

Tax bills in Dodge County go out in fall. Most are due by December 20. Check your bill for the date. You have 60 days from the postmark. After that, interest starts. The rate is set by state law.

| Office Address |

Dodge County Tax Commissioner 5018 Courthouse Circle Eastman, GA 31023 Phone: (478) 374-4365 |

|---|---|

| Hours | Monday - Friday, 8:00 a.m. - 5:00 p.m. |

| Payment Options | Mail, online, or in person |

Payment options in Dodge County are flexible. You can pay by mail with a check. Online payments are accepted too. The office takes cash and checks in person. Credit cards may have fees.

The Tax Commissioner also handles vehicle tags. Many residents visit for both needs. You can renew tags in person. The office gets busy at times. Plan ahead when possible.

How to Appeal Property Assessments in Dodge County

Property owners in Dodge County can appeal assessments. The process starts with your notice. You have 45 days to act. Do not miss this window. Late appeals are not accepted.

First, call the Tax Assessor office. Talk to staff about your concerns. Some issues get fixed at this step. If not, file a formal appeal. You can do this in person. Include your property details.

Appeals go to the Board of Equalization. This panel has local citizens. They hear cases and decide. You can present evidence at the hearing. Bring photos and sales data. Be ready to explain your case.

Three appeal options exist in Georgia. The Board of Equalization is most common. Hearing Officers take complex cases. Binding arbitration is the third choice. Each has rules to follow. Learn more at dor.georgia.gov/property-taxpayers-bill-rights.

Georgia law protects your rights. The Dodge County Tax Assessor follows these rules. Keep all records of your appeal. Take notes at meetings.

Dodge County Homestead Exemptions

Homestead exemptions lower your tax bill in Dodge County. They remove part of your home value from tax. You must own and live in the home. The date is January 1 each year.

To apply, visit the Tax Assessor office. The deadline is April 1. You only apply once. It renews each year. Bring proof of ownership. Show proof you live there.

Seniors may get extra exemptions in Dodge County. Homeowners over 65 can save more. Some get full school tax exemption. Income limits may apply. Disabled veterans get special benefits too.

The basic homestead applies to primary homes. It is the most common type. You will see savings on your bill. The amount due will be less. For questions, call (478) 374-8122.

Understanding Property Assessments in Dodge County

Assessments value property for tax purposes. Dodge County values real estate each year. The goal is fair and uniform values. Georgia law sets the rules. The state requires assessments at 40% of market value.

Assessors review sales data. Recent sales guide values. Location affects price. Size matters too. Condition is reviewed. Improvements add value. Land value is separate.

Assessment notices go out in spring. They show your new value. The notice includes an estimate. This shows what taxes might be. The final amount depends on millage rates.

You can appeal your assessment. You must act fast. The deadline is 45 days. File your appeal in writing. State your reason clearly. Value disputes are valid grounds.

The appeal process has steps. First, file with the Assessors office. They may offer to settle. If you disagree, you can go further. The next step is a hearing. The Board of Equalization hears cases.

Georgia State Tax Resources

The state offers helpful resources. The Department of Revenue oversees property taxes. They publish guides for taxpayers. County facts are listed online. These resources explain the law.

Georgia law protects property owners. You have the right to fair treatment. Assessments must be uniform. Appeals are your right. You can question your value. The process is open and fair.

Millage rates vary by location. The state tracks these rates. County rates are listed. City rates appear too. School rates are separate. All rates combine for your bill.

Cities in Dodge County

Dodge County has several cities. Eastman serves as the county seat. It is the largest city. All properties are assessed by the Dodge County Tax Assessor. Tax bills come from the Dodge County Tax Commissioner.

Other communities in Dodge County include Rhine and Chauncey. All use the same Dodge County property tax records system for assessments and billing.

Nearby Counties and Resources

Dodge County borders several other counties. Each has its own tax offices. Records are kept separately. You must search each county. Neighboring counties include Pulaski to the north. Bleckley County sits to the east. Laurens County is to the southeast. Telfair County lies to the south. Wheeler County is to the southwest. Wilcox County sits to the west.

Eastman is the main city in Dodge County. It serves as the county seat. Most county offices are there. The Tax Assessor is in Eastman. The Tax Commissioner is there too. It is the center of county government.

Additional Dodge County Property Tax Resources

More help is available for Dodge County owners. The Georgia Department of Revenue has county tax facts. Visit dor.georgia.gov/county-property-tax-facts to learn more. This site has state-wide tax info.

The Dodge County office has forms you need. You can get homestead applications. Appeal forms are there too. The office lists hours and phone numbers. You can call with questions.

Property tax records are public in Georgia. Anyone can search them. You do not need to own land. This helps buyers research homes. It helps sellers check values. The system stays fair this way.