Franklin County Property Tax Records and How to Access Them

Franklin County sits in northeast Georgia. Carnesville serves as the county seat. The area spans roughly 264 square miles. It includes rolling hills and farmland. Property owners need access to tax records. The Franklin County Tax Assessor maintains these files. Records are kept up to date. Values reflect current market trends. The county uses QPublic.net for online searches. This system is free for everyone. You can search by name or address. You may also visit the office in Carnesville. Staff are ready to assist you. The county follows Georgia state law. Assessments occur each year. Property owners have appeal rights.

Franklin County Property Tax Quick Facts

How to Search Franklin County Property Tax Records

Franklin County uses QPublic.net for online records. This platform hosts data for many Georgia counties. The search tool is easy to use. You do not need an account. Simply visit the website to begin.

Go to qpublic.net/ga/franklin/ to search. Enter an owner name to locate parcels. You can search by street address too. Parcel numbers yield the best results. Try partial names if needed. The system will display all matches.

Each record displays important details. You will see the assessed value. Land and building values are shown separately. The site lists acreage and size. Structure details appear as well. You can view the year built. Square footage is included. Tax district codes are visible.

Maps help you view the land. You can see property boundaries. Aerial photos show the site. Neighboring parcels appear on screen. This helps with value comparisons. Recent sales data may be shown. Use this to check values.

Carnesville is the heart of the county. The Tax Assessor office is located there. You may visit in person. Staff can help with searches. They explain records in simple terms. Bring your parcel number when you visit.

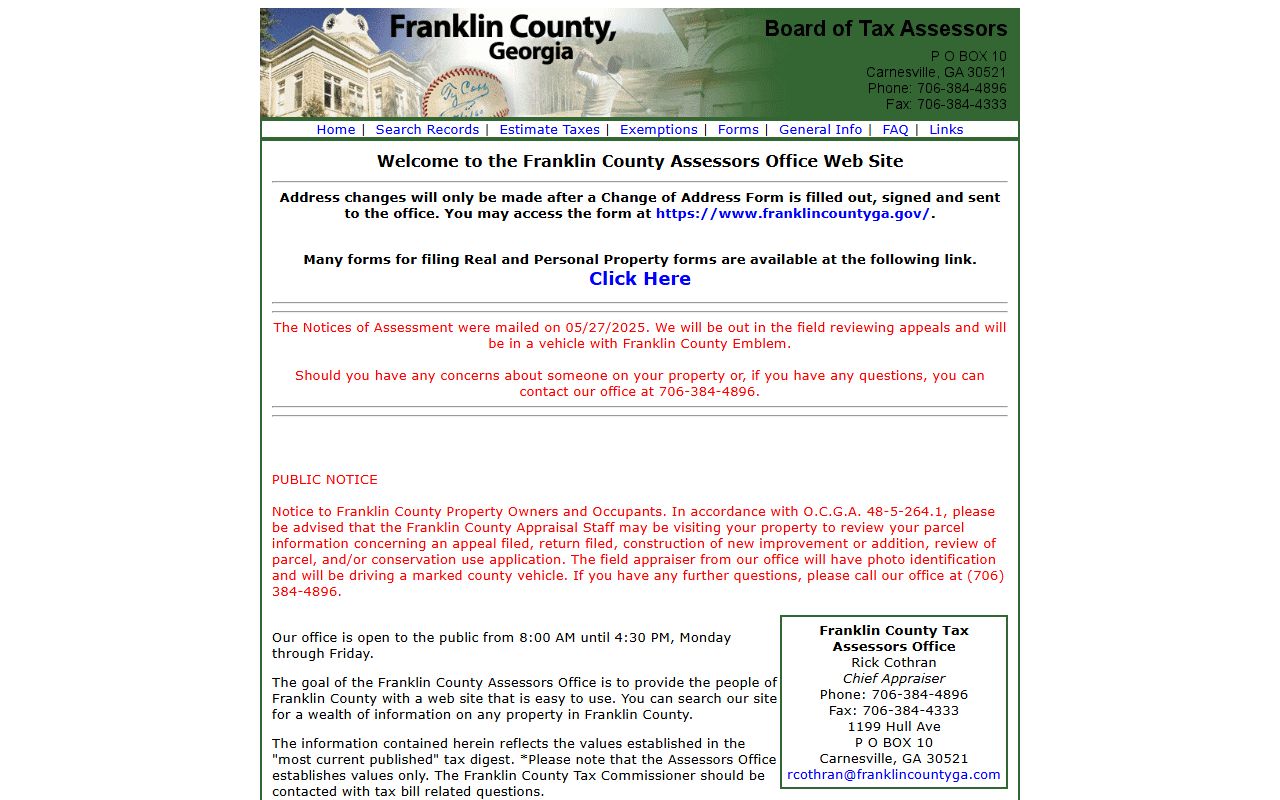

Franklin County Board of Tax Assessors

The Franklin County Board of Tax Assessors sets values each year. Georgia law requires fair market value. The assessed value equals 40% of that amount. A chief appraiser leads the staff. They review sales throughout the county. Market trends guide their decisions.

Assessment notices arrive in spring. These show values for the upcoming tax year. Review your notice with care. It explains your appeal rights. You have 45 days to file. The deadline is strict. Do not miss it.

| Office Address |

Franklin County Board of Tax Assessors 1136 West Greene Street Carnesville, GA 30521 Phone: (706) 384-3440 |

|---|---|

| Mailing Address |

P.O. Box 88 Carnesville, GA 30521 |

| Hours | Monday - Friday, 8:00 AM - 5:00 PM |

| Website | qpublic.net/ga/franklin/ |

The Tax Assessor office provides many services. Staff can explain your assessed value. They offer sales data for your area. You can request copies of records. The office accepts homestead applications. These can reduce your tax bill.

Call the office for assistance. The staff are friendly and trained. They can guide you through appeals. You may visit in person as well. Bring your assessment notice. Write down your questions before you go.

Franklin County Tax Commissioner Office

The Franklin County Tax Commissioner handles tax bills and payments. This office mails bills to property owners. They collect payments and provide receipts. The Tax Commissioner monitors past due accounts. They manage tax sales when required.

Tax bills are sent in the fall. Most are due by December 20. Check your bill for the exact date. You have 60 days from the postmark. After that, interest begins to accrue. The rate is set by state law.

| Office Address |

Franklin County Tax Commissioner 1136 West Greene Street Carnesville, GA 30521 Phone: (706) 384-3454 |

|---|---|

| Mailing Address |

P.O. Box 195 Carnesville, GA 30521 |

| Hours | Monday - Friday, 8:00 AM - 5:00 PM |

| Payment Options | Mail, in person, or online |

Payment options in Franklin County are flexible. You can pay by mail with a check. In-person payments are also accepted. The office takes cash and checks. Ask about online payment options.

The Tax Commissioner also handles vehicle tags. Many residents visit for both services. You can renew tags in person. The office gets busy at times. Plan ahead when possible.

How to Appeal Property Assessments in Franklin County

Property owners in Franklin County can appeal their assessments. The process begins with your notice. You have 45 days to act. Do not miss this deadline. Late appeals are not accepted.

First, contact the Tax Assessor office. Discuss your concerns with staff. Some issues are resolved at this stage. If not, file a formal appeal. You can do this in person. Include your property information.

Appeals go to the Board of Equalization. This panel consists of local citizens. They hear cases and make decisions. You can present evidence at the hearing. Bring photos and sales data. Be prepared to explain your position.

Three appeal options exist in Georgia. The Board of Equalization is the most common. Hearing Officers handle complex cases. Binding arbitration is the third choice. Each has specific rules to follow. Learn more at dor.georgia.gov/property-taxpayers-bill-rights.

Georgia law protects your rights. The Franklin County Tax Assessor follows these rules. Keep all records of your appeal. Take notes during meetings.

Franklin County Homestead Exemptions

Homestead exemptions reduce your tax bill in Franklin County. They remove part of your home value from taxation. You must own and live in the home. The key date is January 1 each year.

To apply, visit the Tax Assessor office. The deadline is April 1. You only need to apply once. It renews automatically each year. Bring proof of ownership. Show proof of residency.

Seniors may qualify for extra exemptions in Franklin County. Homeowners over 65 can save more. Some receive full school tax exemption. Income limits may apply. Disabled veterans receive special benefits too.

The basic homestead applies to primary residences. It is the most common type. You will see savings on your bill. The amount due will be lower. For questions, call (706) 384-3440.

Understanding Property Assessments in Franklin County

Assessments value property for tax purposes. Franklin County values real estate annually. The goal is fair and uniform values. Georgia law sets the standards. The state requires assessments at 40% of market value.

Assessors review sales data. Recent sales guide values. Location affects price. Size matters too. Condition is evaluated. Improvements add value. Land value is separate.

Assessment notices are mailed in spring. They show your new value. The notice includes an estimate. This indicates what taxes might be. The final amount depends on millage rates.

You can appeal your assessment. You must act quickly. The deadline is 45 days. File your appeal in writing. State your reason clearly. Value disputes are valid grounds.

The appeal process has steps. First, file with the Assessors office. They may offer to settle. If you disagree, you can proceed further. The next step is a hearing. The Board of Equalization hears the case.

Georgia State Tax Resources

The state provides helpful resources. The Department of Revenue oversees property taxes. They publish guides for taxpayers. County facts are listed online. These resources explain the law.

Georgia law protects property owners. You have the right to fair treatment. Assessments must be uniform. Appeals are your right. You can question your value. The process is open and fair.

Millage rates vary by location. The state tracks these rates. County rates are listed. City rates appear too. School rates are separate. All rates combine for your bill.

Visit dor.georgia.gov/county-property-tax-facts for more details. This page contains county tax information for all of Georgia. The site is maintained by the state.

Cities in Franklin County

Franklin County has several cities and towns. Carnesville serves as the county seat. Lavonia and Royston are the larger cities. All properties are assessed by the Franklin County Tax Assessor. Tax bills come from the Franklin County Tax Commissioner.

Other communities in Franklin County include Canon and Franklin Springs. All use the same Franklin County property tax records system for assessments and billing.

Nearby Counties and Resources

Franklin County borders several other counties. Each has its own tax offices. Records are kept separately. You must search each county individually. Neighboring counties include Hart to the east. Banks County sits to the west. Stephens County is to the north. Madison County lies to the south.

Carnesville is the main city in Franklin County. It serves as the county seat. Most county offices are located there. The Tax Assessor is in Carnesville. The Tax Commissioner is there too. It is the center of county government.

Additional Franklin County Property Tax Resources

More help is available for Franklin County owners. The Georgia Department of Revenue has county tax facts. Visit dor.georgia.gov/county-property-tax-facts to learn more. This site has state-wide tax information.

The Franklin County office has forms you need. You can get homestead applications. Appeal forms are available too. The office lists hours and phone numbers. You can call with questions.

Property tax records are public in Georgia. Anyone can search them. You do not need to own property. This helps buyers research homes. It helps sellers check values. The system stays fair this way.