Grady County Property Tax Assessment and Records

Grady County sits in the southwest corner of Georgia. Cairo serves as the county seat. This rural county lies near the Florida border. Property tax records are public here. You can access them online or in person. The Tax Assessor and Tax Commissioner manage these records. Both offices are in Cairo. They work to serve Grady County residents. The county uses QPublic.net for online searches. This makes finding records simple and fast.

Grady County Property Tax Quick Facts

Grady County Tax Assessor Office

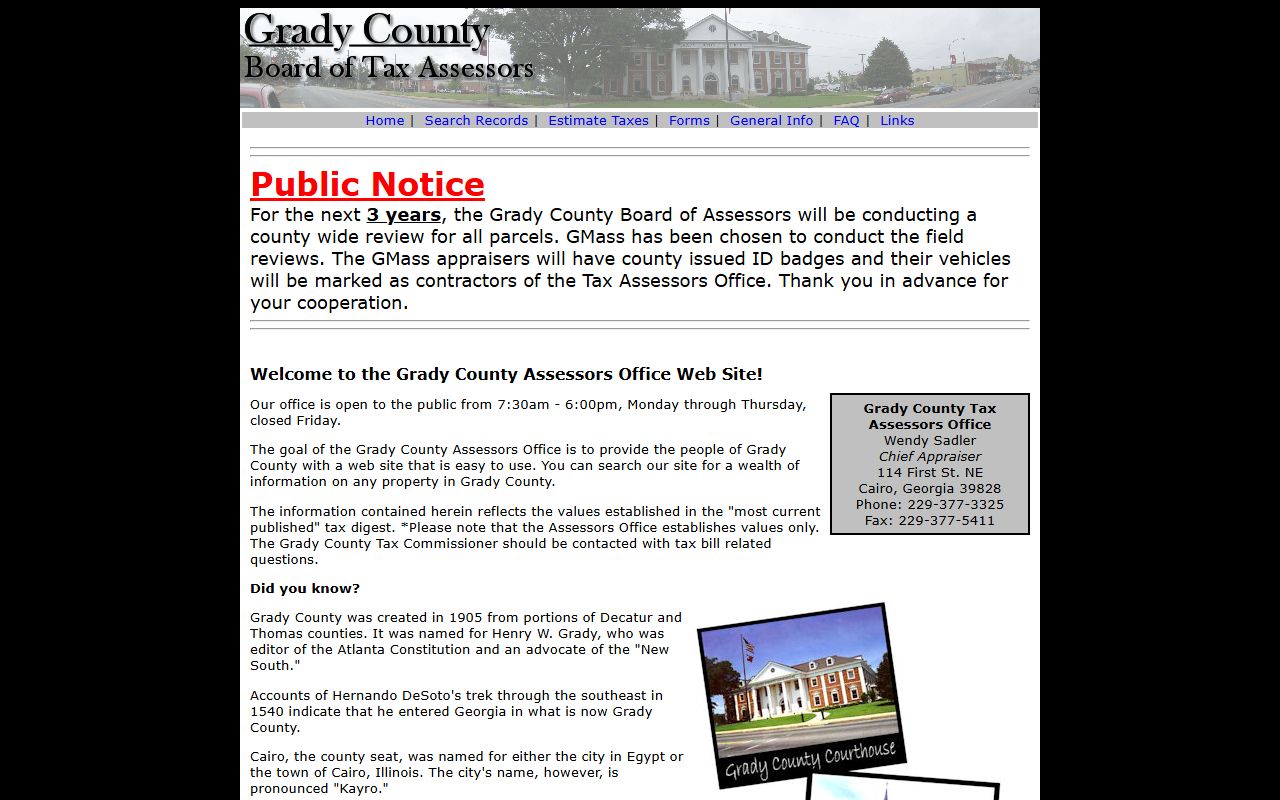

The Grady County Tax Assessor sets property values each year. This office is in Cairo. It serves all of Grady County. The assessor looks at market data. They study sales of similar properties. They check building permits too. All property gets reviewed. This includes homes, farms, and businesses.

Georgia law sets the assessment rate at 40%. This means your assessed value equals 40% of market value. The Tax Assessor applies this rule. They aim for fair and equal values. All property owners get treated the same way.

The Chief Appraiser leads the staff. They follow state guidelines. Property values must reflect true market worth. The office reviews thousands of parcels. Grady County has a mix of rural and urban land. This includes crop fields and timber land. It also includes homes in Cairo and smaller towns.

| Office | Grady County Tax Assessor |

|---|---|

| Address |

114 1st Street NE Cairo, GA 39828 |

| Phone | (229) 377-3325 |

| Fax | (229) 377-3326 |

| Hours | Monday - Friday, 8:00 a.m. - 5:00 p.m. |

| Website | qpublic.net/ga/grady |

You can visit the office in Cairo. The staff will help you find records. You can ask about your property value. You can learn about the appeal process too. The office has public access computers. You can search QPublic.net there.

Assessment notices go out each spring. They show your new value for the year. Read this notice carefully. It tells you how to appeal. You have 45 days to file an appeal. Do not miss this deadline. Late appeals are not accepted.

Grady County Tax Commissioner Office

The Tax Commissioner handles tax bills in Grady County. This office collects all property taxes. They send bills each fall. The money funds local services. Schools, roads, and police all need these funds.

The office is also in Cairo. It is near the courthouse. You can pay your bill in several ways. Pay online for speed. Pay by mail with a check. Visit in person if you prefer. The staff accepts cash, checks, and cards. Card payments have a small fee.

Tax bills are due each December. The exact date may vary. Check your bill for the due date. Late payments earn interest. This adds to your total. Pay on time to save money.

| Office | Grady County Tax Commissioner |

|---|---|

| Address |

114 1st Street NE Cairo, GA 39828 |

| Phone | (229) 377-3322 |

| Fax | (229) 377-3323 |

| Hours | Monday - Friday, 8:00 a.m. - 5:00 p.m. |

The Tax Commissioner also handles motor vehicle tags. You can renew plates at this office. They issue new tags too. This saves you a trip to another office. One stop handles cars and taxes.

If you cannot pay your full bill, ask about options. Payment plans may be available. The staff will work with you. They want to help you stay current. Do not ignore a tax bill. Contact the office right away.

Unpaid taxes can lead to tax sales. The Tax Commissioner manages this process. Properties with long-term debt may be sold. Owners can redeem their property. They must pay all taxes plus fees and interest. Contact the office to learn more.

Grady County QPublic Property Search

Grady County uses QPublic.net for online records. This system is free to use. You can search from any device. Find parcels by owner name. Search by street address. Use the parcel ID if you have it.

The QPublic site shows assessed values. It lists land and building values. You can see property details. This includes acreage and square footage. The site shows sales history too. You can track when a property last sold.

Visit qpublic.net/ga/grady to start. No account is needed. Just enter your search terms. The system will show matches. Click a result for full details.

QPublic offers maps too. View parcel boundaries online. See where your lot lines are. Check nearby properties. This helps when buying land. It helps when planning fences or buildings.

The site works on phones and tablets. You are not tied to a desk. Search records from anywhere. This is great for real estate pros. It helps home buyers too. Investors use it to research properties.

Data on QPublic updates often. New sales appear in the system. Assessment changes post after review. Payment status updates when taxes are paid. You get current info with each search.

The site also offers advanced tools. Search by map if you prefer. Click on a parcel to see details. Download data for multiple parcels. These tools help with bulk research.

How to Appeal Your Grady County Assessment

You have the right to appeal your assessment. Grady County follows state rules. The process is fair and clear. You must act within the appeal window. This is 45 days from your notice date.

First, contact the Board of Tax Assessors. This is an informal step. You can call or visit the Cairo office. Explain why you think the value is wrong. Bring proof to back your claim. An appraiser will review your case.

Good evidence helps your appeal. Find recent sales near your property. These should be similar homes. Same size and age work best. Note any problems with your property. A damaged roof lowers value. Old systems do too. Take photos to show condition.

If you disagree with the first review, go further. File with the Board of Equalization. This board has local citizens. They hear appeals each year. You can present your case to them. Bring all your evidence.

Other appeal paths exist. You can choose a hearing officer. This works for complex cases. Binding arbitration is another choice. It moves faster than other methods. Each option has its own rules.

The Georgia Department of Revenue can help. Visit their site for forms and facts. Learn about your rights as a taxpayer. Find county-specific details. The site is dor.georgia.gov/county-property-tax-facts.

You also have a Taxpayers Bill of Rights. This is state law. It protects property owners. Read it at dor.georgia.gov/property-taxpayers-bill-rights. Know what you are entitled to. Use these rights if needed.

Grady County Property Tax Exemptions

Exemptions lower your tax bill. Grady County offers several types. You must apply to get them. Some are for all homeowners. Others are for special groups.

The basic homestead exemption is for primary homes. You must own and live in the home. It must be your main residence. This exemption takes $2,000 off your assessed value. Apply by April 1. You file once. It renews each year.

Seniors may qualify for more savings. Georgia offers extra exemptions for those 65 and older. Income limits may apply. Some are based on retirement income. Ask the Tax Commissioner about details.

Disabled veterans get special breaks. This honors their service. The exemption amount varies. It depends on the disability rating. Higher ratings get more relief. Surviving spouses may qualify too.

To apply for exemptions, visit the Tax Commissioner. Bring proof of ownership. A deed works well. Bring proof of residence. A driver's license helps. Utility bills work too. For senior or veteran breaks, bring proof of age or service.

The staff will help you file. They will check which exemptions fit you. Processing takes a few weeks. You will get a notice. Your next tax bill will show the savings. Keep the notice for your records.

Farm properties have special rules. Agricultural land gets different rates. Timber land does too. This helps keep farms running. The Tax Assessor handles these cases. Call them if you own farm land.

Cairo Georgia Property Tax Records

Cairo is the county seat of Grady County. It is also the largest city here. The city sits near the Florida line. Cairo is known as the "Syrup City." This name comes from its cane syrup history.

All Cairo properties are in Grady County. The same tax offices serve the city. The same rules apply. Cairo residents use QPublic.net for searches. They visit the Cairo office for help.

The city has a mix of homes and businesses. Downtown Cairo has historic buildings. Suburban areas have newer homes. Rural land surrounds the city. All types are in the tax records.

Nearby Counties

Grady County borders several other counties. If you need records for nearby areas, check these counties. Each has its own tax offices. Each has its own QPublic page.