Understanding Murray County Property Tax Records and Assessments

Murray County property tax records contain essential information about real estate and personal property in north Georgia. The county seat is Chatsworth, located in the foothills of the Appalachian Mountains. The Murray County Tax Assessor uses QPublic.net to maintain and provide access to property assessment data. Property owners can search parcel records, view assessed values, and access tax information through this online portal. Understanding how property taxes work helps residents budget for annual tax obligations and identify available exemptions.

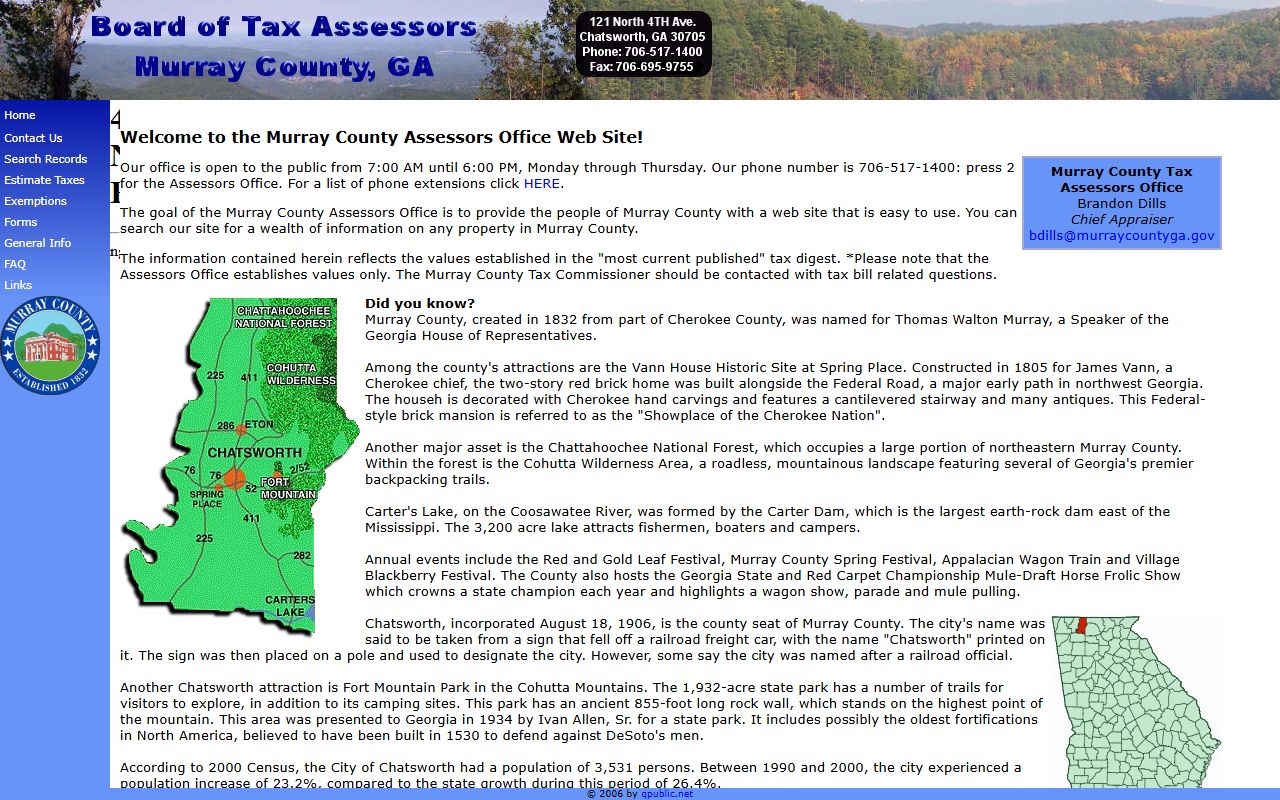

Murray County Quick Facts

Murray County Tax Assessor Office

The Murray County Board of Tax Assessors is responsible for determining property values throughout the county. The assessment process follows Georgia state law and Department of Revenue guidelines. Each year, the assessor reviews property records and market data to establish fair market values for taxation purposes. Properties are assessed at 40% of their estimated fair market value, which is the standard rate applied across Georgia counties.

The Tax Assessor office is located in the courthouse complex in Chatsworth. The historic Murray County Courthouse serves as a central location for government services. The assessor staff maintains detailed records for each parcel of land in the county, including land use classifications, building characteristics, and recent sales information. Property owners can access these records through the online portal or by visiting the office during business hours.

Property assessments in Murray County follow an annual cycle. January 1 serves as the assessment date for each tax year. Values are based on market conditions as of this date. Assessment notices are mailed to property owners in the spring, typically in April or May. These notices detail the new assessed value for the upcoming tax year and include instructions for filing an appeal if the owner disagrees with the valuation.

The Tax Assessor also manages personal property assessments for businesses operating in Murray County. Companies must file annual personal property returns listing equipment, machinery, and inventory. These returns are due by April 1 each year. Failure to file can result in penalties and estimated assessments. Mobile homes, aircraft, and watercraft are also subject to personal property taxation and must be properly registered with the assessor.

To search property records online, visit the QPublic portal at qpublic.net/ga/murray/. This system allows users to search by owner name, property address, or parcel identification number. The online database provides access to current assessment values, property descriptions, and sales history. Many property owners find this online tool convenient for researching values before buying or selling real estate.

| Tax Assessor Office |

Murray County Board of Tax Assessors Murray County Courthouse 121 N 4th Avenue Chatsworth, GA 30705 Phone: (706) 695-2421 |

|---|---|

| Hours | Monday - Friday, 8:00 a.m. - 5:00 p.m. |

| Online Property Search | qpublic.net/ga/murray/ |

Murray County Tax Commissioner Information

The Murray County Tax Commissioner is responsible for billing and collecting property taxes. This office mails annual tax bills to property owners each fall. The Commissioner also maintains payment records, processes partial payments, and manages tax sales for delinquent accounts. Additionally, the Tax Commissioner handles motor vehicle registrations and tag renewals for county residents.

Property tax bills in Murray County are typically mailed by October 15 each year. Taxes become due on November 15 and must be paid by December 20 to avoid penalties and interest. The Tax Commissioner accepts various payment methods including cash, check, money order, and credit or debit cards. Some payment methods may incur additional processing fees, so property owners should inquire about costs before making payments.

The Tax Commissioner office is located in the Murray County Courthouse alongside the Tax Assessor. This central location makes it convenient for residents to handle both assessment questions and payment transactions during the same visit. Office hours are 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding county holidays.

Mortgage companies often handle property tax payments on behalf of homeowners through escrow accounts. If your taxes are paid by a mortgage servicer, you will still receive a copy of the tax bill for your records. It is important to verify that your lender has received and paid the bill by the December deadline to avoid penalties.

| Tax Commissioner Office |

Murray County Tax Commissioner Murray County Courthouse 121 N 4th Avenue Chatsworth, GA 30705 Phone: (706) 695-2441 |

|---|---|

| Hours | Monday - Friday, 8:00 a.m. - 5:00 p.m. |

| Tax Payment Information | Due December 20 each year |

How to Search Murray County Property Records

Murray County provides multiple ways to access property records. The most convenient method is through the QPublic online portal at qpublic.net/ga/murray/. This system allows 24/7 access to property information from any internet-connected device. Users can search by owner name, street address, or parcel number. Search results display current assessment values, property characteristics, and ownership history.

When searching by owner name, enter the last name first followed by the first name for best results. Address searches work well when you know the street name but not the exact owner. The parcel ID search is most precise when you have the complete identification number from a previous tax bill or deed. The QPublic system displays property maps, aerial imagery, and detailed building information alongside assessment data.

For those who prefer in-person assistance, the Tax Assessor office in Chatsworth provides access to public records during business hours. Staff members can help locate specific parcels and explain assessment methodology. The office maintains physical records including maps, plats, and historical assessment data that may not be available online.

The Georgia Department of Revenue maintains county property tax facts for all Georgia counties. Visit dor.georgia.gov/county-property-tax-facts to view current millage rates, exemption information, and other tax-related data for Murray County. This resource helps taxpayers understand how their tax bills are calculated and what services their taxes support.

Property owners have specific rights under Georgia law. The Taxpayer Bill of Rights outlines these protections and is available at dor.georgia.gov/property-taxpayers-bill-rights. This document explains the assessment process, appeal procedures, and available exemptions. Understanding these rights helps property owners navigate the tax system effectively.

Murray County Homestead Exemptions

Georgia law provides several homestead exemptions that reduce property tax burdens for qualifying homeowners. The standard state exemption is $2,000 off the assessed value for owner-occupied primary residences. To qualify, you must own and live in the home as of January 1 of the tax year. Applications must be filed with the Tax Assessor by April 1.

Murray County may offer additional local homestead exemptions beyond the state minimum. Senior citizens age 65 and older may qualify for increased exemptions based on income. Disabled veterans may be eligible for substantial property tax relief depending on the level of service-connected disability. Surviving spouses of veterans or first responders killed in the line of duty may also qualify for special exemptions.

To apply for a homestead exemption, visit the Murray County Tax Assessor office with proof of ownership and residency. Acceptable documents include a Georgia driver's license showing the property address, vehicle registration, voter registration card, or utility bills. The application process must be completed in person the first time, but exemptions typically renew automatically in subsequent years as long as the property remains your primary residence.

If you purchase a new home or move your primary residence, you must file a new homestead exemption application for the new property. The exemption does not transfer automatically between properties. Applications filed after the April 1 deadline will apply to the following tax year, so it is important to apply promptly after moving.

Contact the Tax Assessor at (706) 695-2421 for information about available exemptions and eligibility requirements. The staff can explain which programs you qualify for and help complete the necessary paperwork. Taking advantage of all available exemptions can significantly reduce your annual property tax burden.

Appealing Your Murray County Property Assessment

Georgia law guarantees property owners the right to appeal their assessed values if they believe the assessment is incorrect or unfair. In Murray County, you have 45 days from the date on your assessment notice to file an appeal. This deadline is strictly enforced, and late appeals are generally not accepted.

To file an appeal, submit a written protest to the Murray County Board of Tax Assessors. The appeal must state the grounds for your objection and the value you believe is correct. Common reasons for appeal include claims that the assessed value exceeds fair market value, that the assessment is not uniform with similar properties, or that the property is tax-exempt.

Supporting documentation strengthens your appeal. Recent sales of comparable properties in your area are the most persuasive evidence. Independent appraisals, photographs showing property conditions, and documentation of any issues affecting value should be included with your appeal. The more evidence you provide, the stronger your case will be.

After receiving your appeal, the Board of Tax Assessors may offer to settle by adjusting your value. If you accept a settlement, the appeal process ends. If no settlement is reached or you decline the offer, your case proceeds to a hearing before the Board of Equalization. This independent board of county residents reviews appeals and makes binding decisions on valuation disputes.

Georgia law offers three appeal options beyond the Board of Equalization. You may choose to have your case heard by an independent hearing officer, or you may elect binding arbitration. Each option has different procedures and potential costs. The Tax Assessor office can provide information about these options to help you decide which path to pursue.

Areas in Murray County

Murray County encompasses the city of Chatsworth and various unincorporated communities. Chatsworth serves as the county seat and primary population center. Residents within the city limits of Chatsworth pay both county and municipal property taxes. Unincorporated areas pay only county taxes, though special tax districts may apply for fire protection or other services.

Nearby communities within Murray County include Eton, Cisco, and Crandall. Each area has distinct characteristics affecting property values. Rural properties may qualify for agricultural or conservation use assessments that reduce taxable values. Property owners should contact the Tax Assessor to learn about special assessment programs that may apply to their land.

Note: Verify your tax bill to confirm which taxing jurisdictions apply to your specific property location.