Muscogee County Property Tax Records and Assessment Search

Muscogee County operates as a consolidated government with the city of Columbus. This unique structure means property tax records are managed through one unified system. The consolidated government handles all tax assessments, billing, and collections for the entire county. Property owners in Muscogee County work with the Office of the Tax Assessor and the Tax Commissioner to manage their tax obligations. Both offices share the same downtown Columbus location at 100 10th Street.

Office of the Tax Assessor in Columbus

The Office of the Tax Assessor determines property values in Muscogee County. Staff work to compile an accurate tax digest each year. The tax digest must meet Georgia Department of Revenue standards. State statute governs all assessment activities.

The mission is clear. Staff compile an accurate, uniform, and timely Tax Digest. This digest serves the needs of both state and local officials. The county appraisal staff maintains all assessment records and maps. They keep these records current and accessible.

Training is required. Each staff member completes 40 hours of courses every two years. The State Revenue Commissioner prepares these courses. This ensures staff stay current on laws and methods.

| Office Address |

100 10th Street Columbus, GA 31901 Phone: (706) 653-4398 |

|---|---|

| Website | columbusga.gov/taxassessors |

| Office Hours | Monday through Friday during regular business hours |

The tax assessor office sits in downtown Columbus. This location serves all of Muscogee County. Staff can help with property searches and value questions.

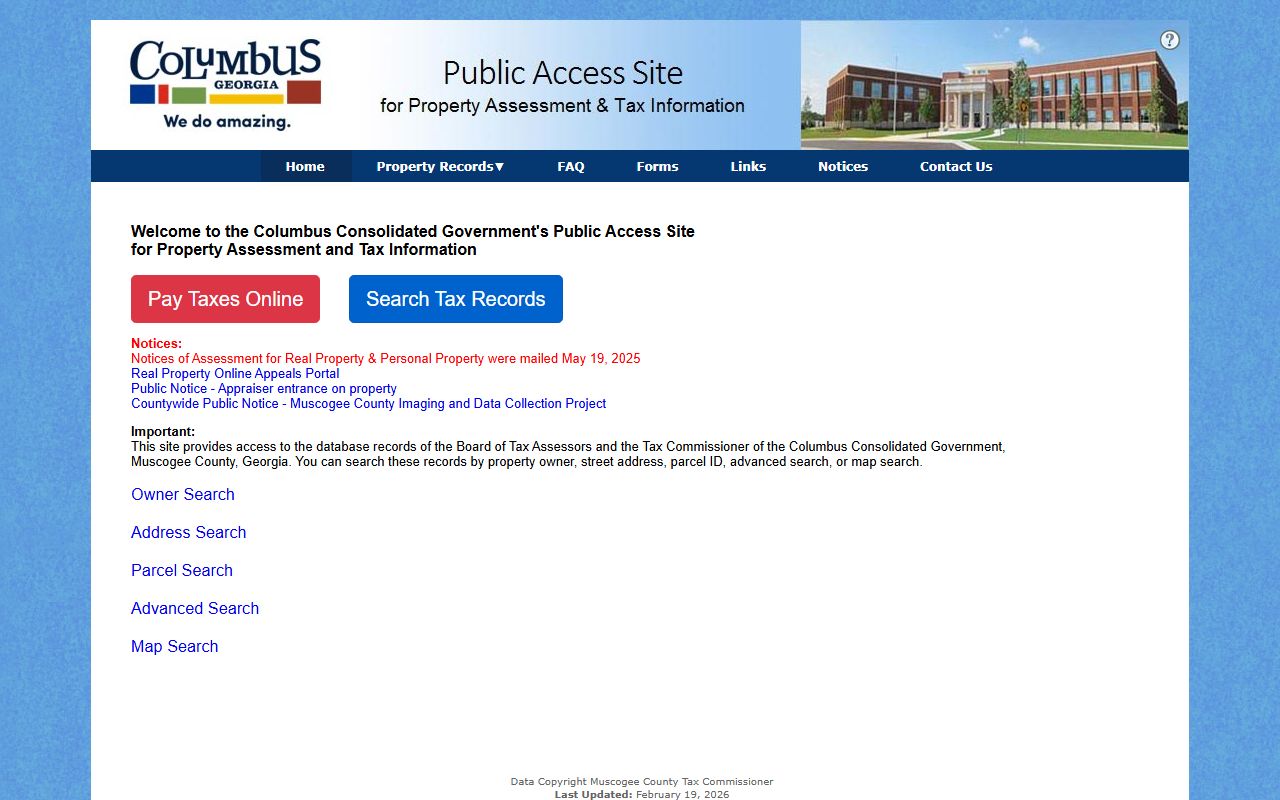

Public Access Portal for Property Records

Muscogee County offers an online Public Access Portal. This system lets you search property records anytime. You can find property details from your home or office. The portal is free to use.

The portal shows ownership information. It displays property values and assessment history. You can view maps and tax records. Sales data is also available.

To use the portal, visit publicaccess.columbusga.gov. You do not need an account. Search by address, owner name, or parcel number. The system returns results instantly. You can print reports or save them.

The portal helps property owners track their assessments. Buyers use it to research properties. Realtors access it for market data. The system serves many needs.

Records are public. Anyone can search any property in Muscogee County. This transparency supports fair taxation. It also aids real estate decisions.

Four Divisions of the Tax Assessor Office

The Tax Assessor office has four main divisions. Each handles different property types. This structure ensures expertise in each area. The divisions work together to serve the county.

The Residential Division assesses homes and residential land. Staff value single-family houses, condos, and townhomes. They also assess apartment buildings. This division handles most properties in Muscogee County.

The Commercial Division values business properties. This includes office buildings and retail stores. Warehouses and industrial sites are also assessed. Commercial properties often have complex valuations.

The Personal Property Division handles business equipment. Companies report their taxable assets each year. This includes machinery and tools. The division ensures fair taxation of these items.

The Administrative Division supports all operations. Staff manage records and customer service. They handle appeals and correspondence. This division keeps the office running smoothly.

Each division has trained staff. They apply state standards to valuations. The goal is fairness across all property types. Property owners can contact the division that serves their needs.

Annual Assessment Notices and Appeals

Beginning in 2011, all taxable real properties receive an Annual Notice of Assessment. This notice tells you your property's assessed value. It shows how the value compares to the prior year. The notice explains your right to appeal.

Notices are usually mailed in May. Watch your mailbox during this month. The notice contains important deadline information. Do not ignore it.

The initial appeal period lasts forty-five days. This window is fixed by law. You must act within this time. Late appeals are not accepted.

If you disagree with your assessment, you can appeal. The process starts with the Board of Tax Assessors. You present evidence supporting your opinion of value. Sales of similar properties help your case.

The consolidated government handles appeals efficiently. Staff review each case carefully. They may adjust values when warranted. Fairness guides all decisions.

Ownership records reflect status as of January 1, 2025. This date determines the tax year. New owners should verify their records are correct. Contact the assessor office with any changes.

Tax Commissioner Office for Payments

The Tax Commissioner collects property taxes in Muscogee County. This office bills all property owners. They process payments and manage collections. The Tax Commissioner works alongside the Tax Assessor.

Both offices share the same address. This makes it convenient for residents. You can visit one location for tax needs. The office is at 100 10th Street in Columbus.

| Office Address |

100 10th Street Columbus, GA 31901 Phone: (706) 653-4208 |

|---|---|

| Website | columbusga.gov/taxcommissioner |

| Services | Tax billing, payment processing, collections, motor vehicle tags |

The Tax Commissioner also handles motor vehicle tags. This combined service benefits residents. You can address multiple needs in one visit. The office accepts various payment methods.

Paying Property Taxes in Muscogee County

Property tax payments support local services. Schools receive funding from these taxes. Police and fire departments benefit. Roads and parks are maintained with tax dollars.

The consolidated government sets tax rates each year. Rates fund county operations and city services. Columbus residents pay to the unified government. Unincorporated areas also pay the same entity.

Tax bills arrive in the fall. The due date is printed on each bill. Late payments incur interest and penalties. Pay on time to avoid extra costs.

You can pay in several ways. Visit the office in person. Mail your payment to the address on the bill. Online payment options may be available. Check the Tax Commissioner website for details.

Keep your receipt. Proof of payment protects you. The consolidated government updates records promptly. Verify your payment posted correctly.

Consolidated Government Benefits

Muscogee County merged with Columbus years ago. This created a consolidated government. The merger streamlined many services. Property tax administration is more efficient as a result.

One government serves all residents. There is no separate city tax bill. County and city services are unified. This simplifies tax collection.

The consolidated government maintains one set of records. Staff serve both urban and rural areas. Resources are shared across the county. Taxpayers benefit from reduced duplication.

The main county website is columbusga.gov. This site links to all tax services. You can find forms and information there. Contact details are also posted.

Related Areas

Columbus is the county seat of Muscogee County. The consolidated government serves this major Georgia city. Property owners in Columbus use the same tax systems as all Muscogee County residents.

Additional Resources

These official sources provide more information about property taxes in Muscogee County and Georgia state requirements.

Office of the Tax Assessor - Property valuations and assessment notices

Public Access Portal - Online property records search

Tax Commissioner - Tax billing and payment information

Columbus Consolidated Government - Main county and city website

Georgia Department of Revenue - State tax information and resources