Pierce County Property Tax Records and Assessment Information

Pierce County is located in Southeast Georgia along the Florida border. Blackshear serves as the county seat and hosts all major county offices. Property taxes in Pierce County fund essential public services including schools, infrastructure, and emergency response. The county maintains detailed property tax records that are available for public inspection. Property owners and researchers can access these records through multiple channels. The Tax Assessor determines property values annually using established appraisal methods. The Tax Commissioner handles billing and collection of all property taxes. Online access is available through the QPublic.net portal, which provides convenient 24-hour access to parcel data.

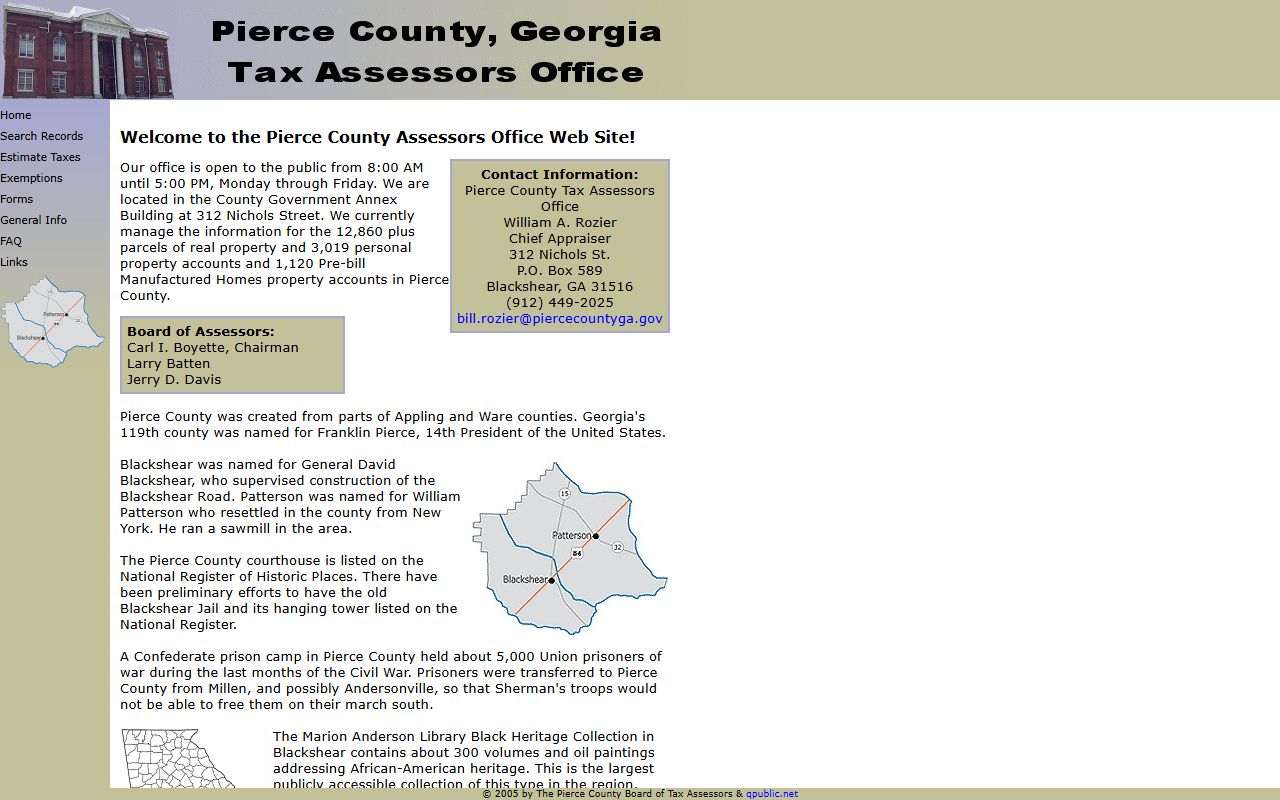

The Pierce County Courthouse in Blackshear houses the tax assessor and tax commissioner offices for property tax records.

Pierce County Tax Assessor Office

The Pierce County Tax Assessor office is located in Blackshear at 312 Nichols Street. The Chief Appraiser oversees the valuation of all real property in the county. Assessment notices are mailed to property owners each spring. These notices detail the proposed value for the upcoming tax year. Property owners can contact the office at (912) 449-2025 with questions about their assessments. The staff can explain valuation methodologies and review property characteristics on file.

The Tax Assessors Office accepts appeals from property owners who disagree with their valuations. The appeal process follows guidelines established by the Georgia Department of Revenue. Appeals must be filed within 45 days of the assessment notice date. The Board of Tax Assessors reviews all appeals and makes determinations based on evidence presented. Property owners may present comparable sales data, independent appraisals, or documentation of property condition issues.

The mailing address for the Pierce County Tax Assessor is P.O. Box 589, Blackshear, GA 31516. Office hours are typically Monday through Friday during standard business hours. The office closes for state and federal holidays. Walk-in visitors are welcome, though calling ahead can save time for complex inquiries. The assessor maintains records for all land parcels, residential properties, commercial buildings, and agricultural operations. Personal property including business equipment, aircraft, and manufactured homes must also be reported for taxation.

Visit the official Pierce County property search page at qpublic.net/ga/pierce to access online assessment records and parcel maps.

Pierce County Property Search Options

Pierce County utilizes the QPublic.net system for online property record access. This free service allows users to search by owner name, property address, or parcel identification number. The database contains current assessment values, property characteristics, and sales history. Users can view tax maps and aerial photography of properties. Building sketches and improvement details are available for many parcels. The system operates continuously and can be accessed from any internet-connected device.

The online search tool benefits property owners, real estate professionals, and researchers. Results display instantly, allowing users to review multiple properties efficiently. Property cards can be printed or saved for reference. The mapping feature shows parcel boundaries and dimensions. Sales data helps users understand market trends in specific neighborhoods. Photos of properties are included when available.

For records not available online or for historical research, the Tax Assessor office provides in-person assistance. Staff can access archived records and specialized databases. The office maintains physical maps and plat books dating back many decades. Researchers studying property lineage or historical valuations may need to visit in person. Public access computers are available for self-directed searches.

The Georgia Department of Revenue maintains county-specific tax information at dor.georgia.gov/county-property-tax-facts including millage rates and assessment procedures for Pierce County.

Pierce County Property Assessment Process

Property assessments in Pierce County follow the requirements of Georgia law. All real property is valued at 40 percent of its fair market value. Market value represents the probable selling price in an arms-length transaction. Assessors analyze recent sales of comparable properties to establish values. Property characteristics including size, location, condition, and improvements are factored into each valuation.

The assessment cycle operates on a calendar year basis. January 1 serves as the assessment date for all properties. Values are based on market conditions as of that date. Assessment notices are typically mailed by mid-April. These notices indicate both the prior year and proposed values. The notice includes instructions for filing an appeal if the property owner disagrees with the valuation.

Property owners have 45 days from the notice date to file an appeal. The appeal deadline is strict and enforced. Late appeals are generally not accepted except under specific circumstances. Appeals are filed with the Board of Tax Assessors. The appeal process may involve a hearing before the Board of Equalization. Alternative dispute resolution options include arbitration and hearing officers. Property owners should prepare supporting documentation such as recent appraisals or sales of similar properties.

Homestead exemptions reduce tax liability for primary residence owners. The standard state homestead exemption is available to qualified homeowners. Applicants must own and occupy the property as their permanent residence. Applications must be filed by April 1 of the tax year. Additional exemptions are available for seniors, disabled veterans, and surviving spouses. The Tax Commissioner processes exemption applications and can provide information about all available programs.

Learn more about taxpayer rights and appeal procedures at dor.georgia.gov/property-taxpayers-bill-rights. This resource explains the assessment and appeal process in detail.

Paying Pierce County Property Taxes

The Pierce County Tax Commissioner manages the billing and collection of property taxes. Tax bills are mailed to property owners in the fall each year. The standard due date for payment is December 20. Property owners should ensure payment is received by this date to avoid penalties. Late payments accrue interest and penalties according to state law.

Multiple payment methods are available for taxpayer convenience. Online payments can be made through the county's payment portal. Credit cards and electronic checks are accepted for online transactions. Convenience fees may apply for credit card payments. Payments by mail should include the tax bill stub and be sent to the Tax Commissioner office. Checks should have the parcel number written on them for proper credit. In-person payments are accepted at the Blackshear office during business hours.

Property tax amounts are calculated using the assessed value and millage rates. The assessed value is multiplied by the total millage rate to determine the tax due. Millage rates are set by the county commission, school board, and any applicable city councils. Each taxing authority establishes its rate based on budget requirements. The combined millage rate appears on the tax bill. Rates may change annually depending on governmental funding needs.

Property owners experiencing financial hardship should contact the Tax Commissioner office promptly. Payment plans may be available for qualifying taxpayers. The office works with property owners who communicate their situations. Unpaid taxes can result in tax lien sales or foreclosure proceedings. The county provides multiple notices before taking enforcement action. Maintaining current address information with the tax office ensures receipt of all notices and bills.

Nearby Counties Property Tax Records

Pierce County borders several other Georgia counties. Property owners near county boundaries may need records from adjacent jurisdictions. The following counties neighbor Pierce County: