Baldwin County Property Tax Information and Records Search

Baldwin County sits in central Georgia. The county seat is Milledgeville. This historic city once served as the state capital. Property tax records in Baldwin County are public documents. They show who owns land and buildings. They list how much each property is worth. The Board of Tax Assessors manages these records. You can search for property tax records online. You can also call or visit the office in Milledgeville.

Baldwin County Tax Facts

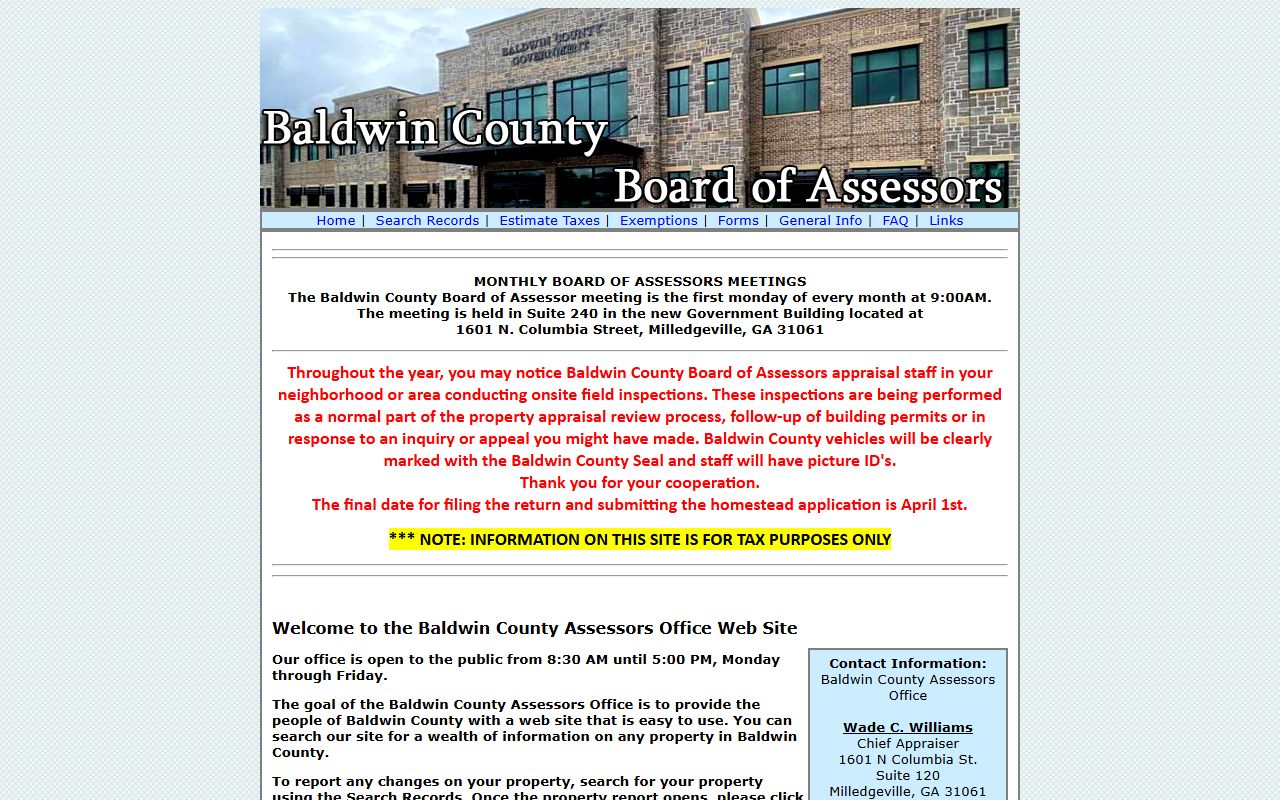

Baldwin County Board of Tax Assessors

The Board of Tax Assessors sets all property values in Baldwin County. They do not send tax bills. They do not collect money. Their only job is to find fair market value. Georgia law requires a 40 percent assessment ratio. This means your assessed value is 40 percent of market value.

The office is in Milledgeville. Staff work Monday through Friday. Call them at (478) 445-5016. You can also search records online. The website is qpublic.net/ga/baldwin.

Assessment notices go out each spring. The notice tells you your new value. It also gives the appeal deadline. You have 45 days to appeal. Do not miss this date. Late appeals are not accepted.

| Office Location |

121 N. Wilkinson Street Milledgeville, GA 31061 |

|---|---|

| Phone | (478) 445-5016 |

| Online Search | qpublic.net/ga/baldwin |

Note: The Board of Tax Assessors only handles valuations. They do not handle tax payments.

Baldwin County Tax Commissioner

The Tax Commissioner collects property taxes. This office mails tax bills each year. They process all payments. They also handle motor vehicle tags. The Tax Commissioner works with the values set by the Board of Assessors.

Tax bills are based on the assessed value. The county and cities set millage rates. These rates are applied to your assessed value. The result is your tax amount. Bills usually go out in the fall. Payment is due by December 20.

You can pay your taxes in several ways. Pay online through the county website. Pay in person at the courthouse. Pay by mail with a check. Some banks also take payments. Late payments earn interest and penalties. Contact the Tax Commissioner if you need a payment plan.

How to Search Baldwin County Property Records

Baldwin County uses QPublic for online property searches. This system is free. You do not need an account. Go to qpublic.net/ga/baldwin to start your search.

The search system offers many ways to find records. Search by owner name. Type the last name first. Search by property address. Enter the street number and road name. Search by parcel number. Each property has a unique parcel ID.

Results show key facts about the property. You will see the owner's name. You will see the mailing address. You will see the property location. The system shows land value and building value. It shows the total assessed value. This is always 40 percent of fair market value.

Maps are also available. The GIS map shows property lines. You can see where the land sits. You can view nearby parcels. Zoning info may also show up. This helps you understand the area.

Both real and personal property records are in the system. Real property means land and buildings. Personal property includes business equipment. Mobile homes are personal property. The system covers all taxable items in Baldwin County.

Understanding Property Assessments and Appeals

Georgia law shapes how property is valued. Fair market value is the key term. It means what a willing buyer would pay. It means what a willing seller would take. Both must know the facts. Neither should feel forced.

The 40 percent rule applies to all property. Take your market value. Multiply by 0.40. That gives your assessed value. Millage rates are then applied. Each government sets its own rate. The county has a rate. The schools have a rate. Cities may add more.

You can appeal if you disagree. You have 45 days from the notice date. The deadline is strict. Mark your calendar. File on time. There are three appeal paths. You can go to the Board of Equalization. You can pick a hearing officer. You can choose binding arbitration.

To appeal, fill out a form. Get it from the Assessor's office. Or download it from their site. State why the value is wrong. Give proof to back your claim. Recent sales of similar homes help. Photos of damage can help. A paid appraisal is strong proof.

The Board will look at your appeal. They may call you for a hearing. Bring all your evidence. Be ready to speak. The Board will make a choice. They may lower the value. They may keep it the same. They could even raise it. You can appeal more if needed.

Georgia protects property owners. The Taxpayer's Bill of Rights gives you power. The Board must explain big value jumps. They must give you a contact person. You can record your talks with them. Learn more at dor.georgia.gov/property-taxpayers-bill-rights.

Note: Missing the 45-day deadline means you must wait until next year to appeal.

Baldwin County Homestead Exemptions

Homestead exemptions lower your tax bill. They apply to your primary home. You must live there as of January 1. You must own the home. You file with the Tax Commissioner. The deadline is April 1.

Georgia gives a basic state exemption. It takes $2,000 off your assessed value. Baldwin County may offer more. Some local exemptions are for seniors. Some are for veterans. Some help disabled residents. Check with the Tax Commissioner for all options.

File your application once. It renews each year after that. You only need to file again if you move. You must also file again if your deed changes. Keep your info up to date.

Nearby Counties

These counties are near Baldwin County. Check which county handles your property if you live near a line. Each county has its own tax office.

Additional Resources

These links offer more help with Baldwin County property taxes. Use them for forms, facts, and state rules.

Baldwin County QPublic - Online property search and records

Georgia DOR County Property Tax Facts - Tax facts for all counties

Georgia Property Taxpayer's Bill of Rights - Your rights as a taxpayer