Screven County Property Tax Assessment Records and Lookup Guide

Screven County sits in the eastern part of Georgia near the South Carolina border. Sylvania serves as the county seat and hosts the main government offices. The Screven County Tax Assessor values all real property within county boundaries. Staff review market data annually to ensure fair and uniform assessments. Property owners can access records online through the county's partnership with QPublic.net. This digital system allows searches by owner name, property address, or parcel number. The Tax Assessor office in Sylvania provides in-person assistance for complex questions and official documentation requests.

Screven County Property Tax Quick Facts

How to Search Screven County Property Tax Records

Screven County partners with QPublic.net to provide online property tax records. This platform serves many Georgia counties with a standardized search interface. Property owners, buyers, and researchers can access assessment data without creating an account. The system contains current year valuations plus historical records for comparison purposes.

To begin your search, visit qpublic.net/ga/screven/. Enter search criteria in the provided fields. You may search by owner name for personal properties or by street address for specific locations. Parcel identification numbers deliver the most precise results when available. The database returns matching properties with summary information displayed.

Click any search result to view detailed property information. The detail pages show land value separate from building improvements. Total assessed value appears prominently for tax calculation purposes. Property characteristics include acreage, square footage, year built, and construction type. Some records display sales history when transactions have been recorded.

The QPublic system benefits various users throughout Screven County. Homeowners verify their assessment accuracy before tax bills arrive. Prospective buyers research property values before making purchase offers. Real estate professionals analyze market trends across different neighborhoods. Investors evaluate portfolios and identify new opportunities. Attorneys and title companies confirm ownership details for transactions.

Sylvania functions as the governmental center for Screven County. The historic downtown area houses multiple county offices including the Tax Assessor. Visitors find the courthouse complex easily accessible from major highways. The Tax Commissioner office operates nearby for payment and billing inquiries. This central location streamlines property tax matters for residents.

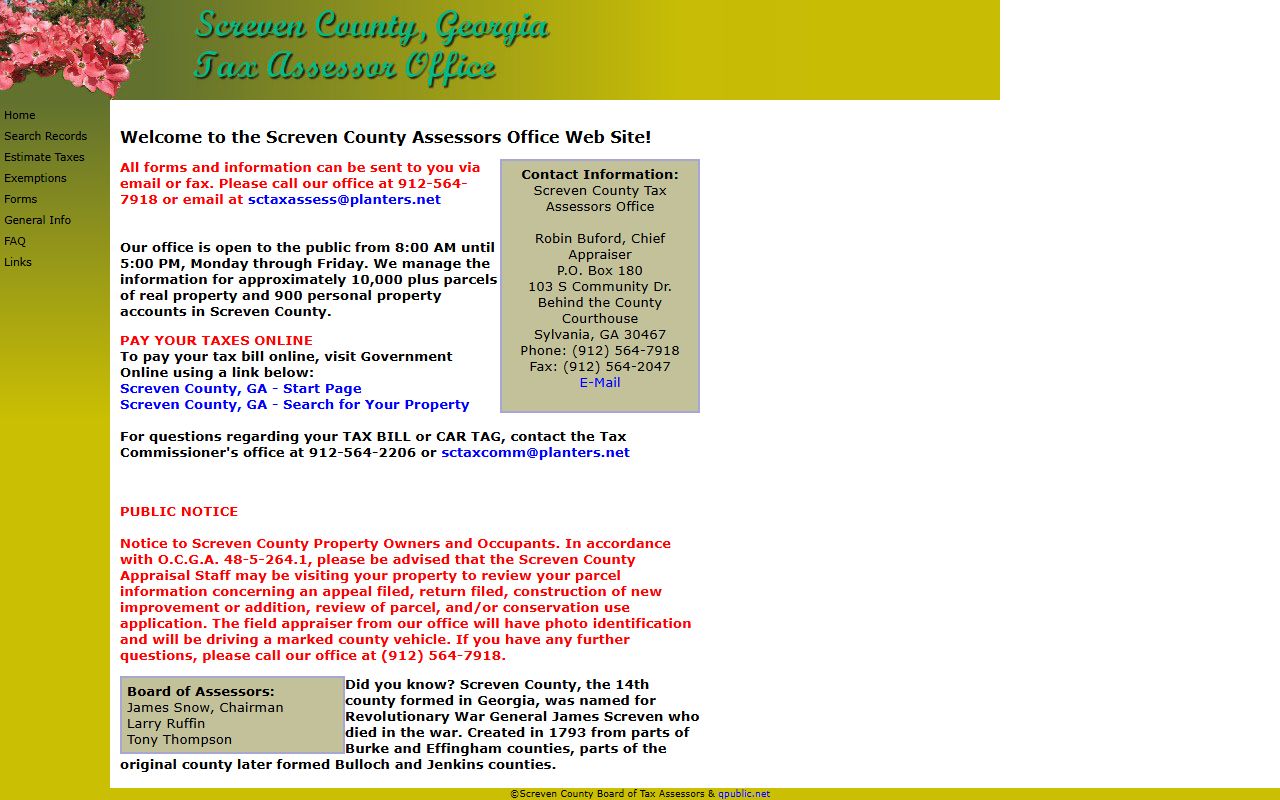

Screven County Tax Assessor Office

The Screven County Tax Assessor determines property values for taxation purposes each year. Georgia law mandates assessments at fair market value using standardized methods. The assessed value equals forty percent of the established market value. This assessment ratio applies uniformly across all property types in the county.

Chief appraisers and staff conduct regular property reviews throughout Screven County. Field inspections verify building characteristics and property conditions. Sales data analysis ensures valuations reflect current market conditions. New construction receives assessment upon completion. Renovations and improvements may trigger value adjustments.

Annual assessment notices arrive by mail during spring months. These documents notify owners of proposed values for the upcoming tax year. Careful review of assessment notices protects taxpayer rights. Errors or discrepancies should be reported promptly to the Tax Assessor office.

| Office Address |

Screven County Tax Assessor 216 Mims Road Sylvania, GA 30467 Phone: (912) 564-2123 |

|---|---|

| Hours | Monday - Friday, 8:30 a.m. - 5:00 p.m. |

| Property Search | qpublic.net/ga/screven/ |

| State Resources | dor.georgia.gov/county-property-tax-facts |

The Tax Assessor office provides multiple services beyond basic valuation. Staff explain assessment methodologies upon request. Comparable sales data from your area can be obtained at no charge. Property record cards document land and building characteristics. Homestead exemption applications are processed through this office.

Contact the Tax Assessor with questions about your property value. Staff members assist with understanding assessment notices. They guide taxpayers through the appeal process when disagreements arise. Office visits allow face-to-face discussion of complex issues. Telephone support addresses routine inquiries efficiently.

Screven County Tax Commissioner Information

The Screven County Tax Commissioner manages property tax billing and collection operations. This constitutional office mails annual tax bills to all property owners. Payment processing and receipt issuance fall under Tax Commissioner responsibilities. The office tracks delinquent accounts and initiates collection proceedings when necessary.

Tax bills in Screven County typically arrive during autumn months. Payment deadlines are clearly printed on each bill. Most property taxes become due by December twentieth each year. The sixty-day payment window allows time for financial planning. Interest and penalties accrue on unpaid balances after the deadline.

| Office Address |

Screven County Tax Commissioner 216 Mims Road Sylvania, GA 30467 Phone: (912) 564-2133 |

|---|---|

| Hours | Monday - Friday, 8:30 a.m. - 5:00 p.m. |

| Payment Options | Mail, in person, or online |

| Taxpayer Rights | dor.georgia.gov/property-taxpayers-bill-rights |

Payment methods accepted by the Tax Commissioner vary by location. Traditional options include mailing checks or money orders. In-person payments use cash, check, or card at the Sylvania office. Online payment portals may be available for electronic transactions. Contact the office to confirm current payment options and any associated fees.

The Tax Commissioner also oversees motor vehicle registration and tag renewal services. Many Screven County residents handle multiple transactions during single office visits. Peak periods include month-ends and tax bill due dates. Planning visits during slower times reduces waiting periods.

Tax lien auctions occur when property taxes remain unpaid for extended periods. The Tax Commissioner coordinates these proceedings according to Georgia law. Properties with significant tax delinquencies may be sold at public auction. The primary goal remains tax collection rather than property seizure. Most owners resolve delinquencies before auction stage through payment plans.

How to Appeal Property Assessments in Screven County

Property owners in Screven County possess the right to appeal assessments they believe incorrect. The appeal process begins with timely action following assessment notice receipt. Georgia law establishes a forty-five day appeal window from the notice date. Missing this deadline forfeits appeal rights until the following tax year.

Initial resolution attempts should contact the Tax Assessor office directly. Informal discussions sometimes resolve valuation disagreements without formal appeals. Staff may explain valuation methods or correct obvious errors. Many concerns are addressed through this cooperative approach.

Formal appeals require written submission to the Tax Assessor. The appeal form must include property identification and grounds for disagreement. Supporting documentation strengthens appeal cases significantly. Recent sales of comparable properties provide persuasive evidence. Professional appraisals carry substantial weight in appeal hearings.

Screven County appeals are heard by the Board of Equalization. This independent body comprises local residents appointed to three-year terms. The board schedules hearings where appellants present their cases. Both oral testimony and written evidence are considered. Written decisions are issued following deliberation.

Georgia provides three distinct appeal pathways for property owners. The Board of Equalization handles most appeals through local hearings. Hearing Officers offer expertise for complex valuation disputes. Binding arbitration delivers faster resolution with final decisions. Each option has specific procedures and requirements.

Taxpayers who successfully reduce assessments to eighty-five percent or less may recover appeal costs. Eligible expenses include appraisal fees and certain legal costs. Detailed record-keeping throughout the appeal process supports cost recovery claims.

Screven County Homestead Exemptions

Homestead exemptions reduce property tax burdens for primary residence owners in Screven County. These programs exclude portions of home value from taxation. Eligibility requires ownership and occupancy as of January first of the tax year.

The standard state homestead exemption removes two thousand dollars from assessed value. Screven County may offer additional local exemptions beyond this base amount. Combined exemptions can produce meaningful tax savings for qualifying homeowners.

Application for homestead exemptions occurs at the Tax Assessor office. The filing deadline is April first each year. Once approved, exemptions automatically renew for subsequent years. Documentation requirements include proof of ownership and residency verification.

Senior citizens age sixty-five and older may qualify for enhanced exemptions. Income limitations apply to certain senior programs. School tax exemptions provide substantial relief for eligible older homeowners. The savings appear automatically on qualifying tax bills.

Disabled veterans receive special consideration under Georgia law. Service-connected disability ratings determine exemption amounts. Some veterans receive complete property tax elimination. Surviving spouses may continue certain veteran exemptions.

Contact the Screven County Tax Assessor at (912) 564-2123 for exemption information. Staff members explain available programs and eligibility requirements. Application assistance ensures proper completion of required forms. Understanding all available exemptions maximizes potential tax savings.

Nearby Counties

Screven County shares borders with several Georgia counties and the South Carolina state line. Property tax records for adjacent jurisdictions may be relevant for regional research.

Additional Screven County Property Tax Resources

The Georgia Department of Revenue maintains comprehensive property tax information online. Visit dor.georgia.gov/county-property-tax-facts for state-level tax data and policy explanations. This resource covers assessment procedures, appeal rights, and exemption programs.

Property tax records remain publicly accessible under Georgia law. No ownership requirement exists for searching these records. Transparency supports informed real estate decisions and assessment fairness. Screven County maintains this commitment through online access and open office policies.