Property Tax Records for DeKalb County in Decatur

DeKalb County property tax records help owners track assessments and tax bills. The county seat is Decatur. This county sits east of Atlanta. Over 750,000 people live here. The Board of Assessors sets property values each year. The Tax Collector sends out bills and takes payments. Both offices keep records that the public can view. You can search these records online or in person. The data shows what your home is worth. It also shows what you owe in taxes each year.

DeKalb County Quick Facts

DeKalb County Board of Assessors Office

The Board of Assessors handles all property tax assessments in DeKalb County. This office works under the Georgia Revenue Codes. It appraises every piece of real estate in the county. Staff also value personal property like business equipment. The board meets every other Thursday at 9:30 a.m. These meetings are open to the public. You can attend to learn about the assessment process in DeKalb County.

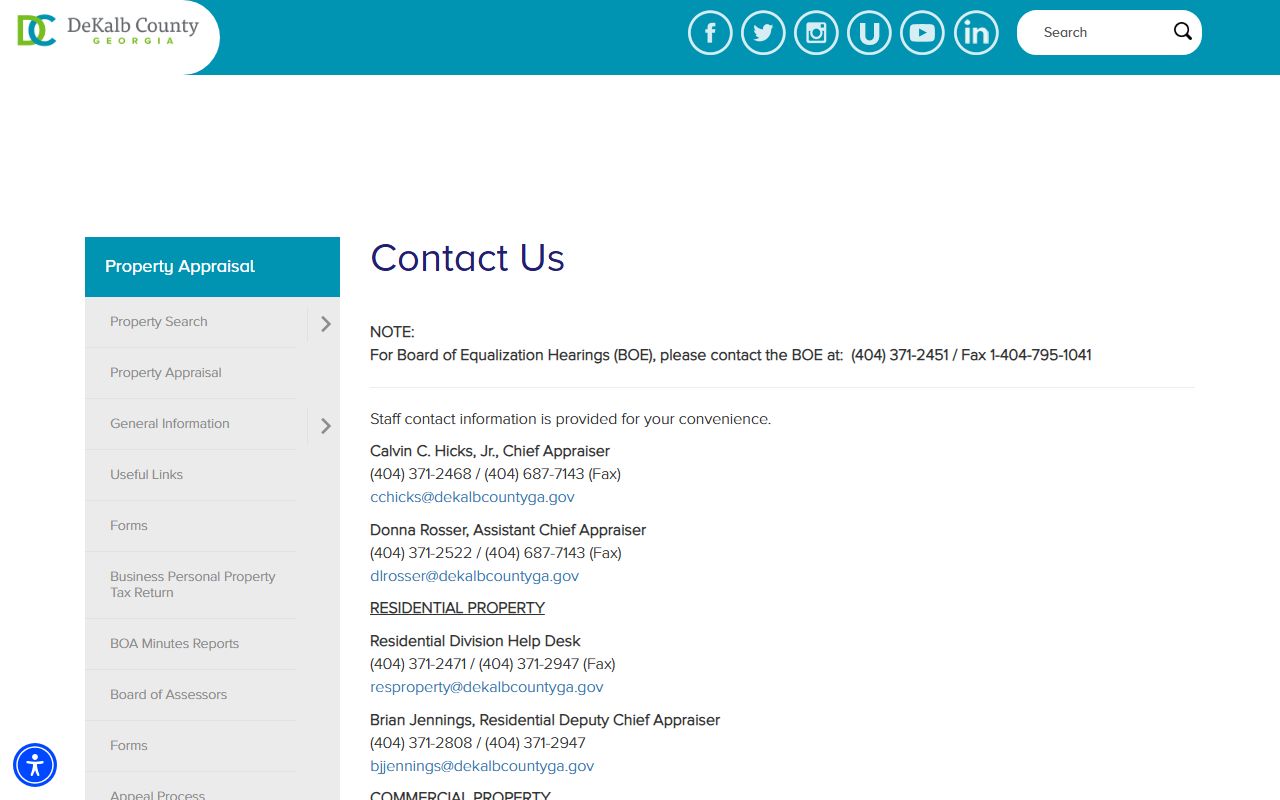

Calvin C. Hicks, Jr. serves as Chief Appraiser. He oversees all assessment work. Donna Rosser works as Assistant Chief Appraiser. Brian Jennings leads the residential team. Vance Clements manages personal property. This team ensures fair and uniform values across DeKalb County. They follow state laws and best practices.

| Address |

Maloof Annex 1300 Commerce Drive Decatur, GA 30030 |

|---|---|

| Phone | (404) 371-2471 (Residential Help Desk) |

| Fax | (404) 371-2947 |

| resproperty@dekalbcountyga.gov | |

| Hours | 8:30 a.m. to 5:00 p.m. Monday through Friday |

| Website | dekalbcountyga.gov/property-appraisal |

Note: The Chief Appraiser can be reached directly at (404) 371-2468 or cchicks@dekalbcountyga.gov.

How Property Assessment Works in DeKalb County

DeKalb County appraises all property at fair market value. This means your home is valued at what it would sell for on the open market. The county uses 100 percent of this value. Then it applies the 40 percent assessment ratio. Your tax bill is based on this assessed value. The process happens each year for all real estate in DeKalb County.

Assessment notices go out in late May or early June. Check your mail for this important document. It shows your property value for the year. Look at it closely. Make sure the facts about your home are right. The notice lists your land value and building value. It also shows any exemptions you receive.

If you think your value is too high, you have options. You can file an appeal. The deadline is 45 days from the date on your notice. Do not miss this window. Late appeals will not be heard. The appeal goes to the Board of Equalization. This group reviews your case. They may lower your value if you prove it is wrong.

Property tax returns are due each year. File between January 1 and April 1. All returns must be postmarked by April 1. The postmark must come from the U.S. Postal Service. Late returns may face penalties. File even if your value stayed the same. This protects your rights in DeKalb County.

Note: Operating under the Georgia Revenue Codes, the Board of Assessors is responsible for the appraisal and assessment of all residential, commercial and personal property in DeKalb County.

DeKalb County Tax Commissioner

The Tax Commissioner handles tax bills and payments in DeKalb County. This office does not set your property value. It only collects what you owe based on the assessed value. The Tax Commissioner sends bills each year. You can pay online, by mail, or in person. Many people use the online system for ease.

Different types of taxes go to different addresses. Send property tax payments to one P.O. box. Send motor vehicle taxes to another. Delinquent collections go to a third address. Use the right address to avoid delays. Your tax bill will show where to send payment.

| Phone | (404) 298-4000 |

|---|---|

| Website | dekalbtax.org |

| Property Tax Mailing | DeKalb County Tax Commissioner, Property Tax Division, P.O. Box 100004, Decatur, GA 30031-7004 |

| Motor Vehicle Mailing | P.O. Box 100025, Decatur, GA 30031-7025 |

| Delinquent Collections | P.O. Box 100001, Decatur, GA 30031-7001 |

Note: Property is appraised at 100 percent of its fair market value and assessed at 40 percent of that value in DeKalb County.

Filing an Appeal in DeKalb County

You have the right to appeal your property assessment. Many owners do this each year. The process starts when you get your notice. You have 45 days to act. Mark your calendar. Do not wait until the last minute.

The Board of Equalization hears appeals in DeKalb County. This is a separate body from the Assessors. They review evidence from both sides. Then they issue a decision. You can appeal their ruling to court if needed. But most cases settle at this level.

Gather proof before you file. Find sales of similar homes near you. Get photos of your property. Note any defects that lower value. Hire an appraiser if you can. The stronger your evidence, the better your chance of success. Present this to the board in a clear way.

Contact the Board of Equalization to start your appeal. Call (404) 371-2451 with questions. You can fax documents to 1-404-795-1041. Staff will guide you through the steps. They will set a hearing date. You can attend in person or send a rep. The hearing is your chance to present your case. Be ready to explain why your value is wrong.

Note: The Board of Equalization can be reached at (404) 371-2451 for appeals in DeKalb County.

Personal Property Tax in DeKalb County

Personal property is taxed in DeKalb County too. This includes business equipment, aircraft, boats, and motors. If you own these items, you must file a return. The deadline is April 1 each year. Do not ignore this rule. Penalties apply for late or missing returns.

You must report all taxable personal property. The Assessors do not track this for you. It is your duty to file. List each item you own. State its purchase price and year. The county uses this to set your tax bill. Failure to report can result in fines.

Business owners need to pay special heed. Office furniture counts. So do computers and tools. Even leased equipment may be taxable. Check with the Assessors if you are unsure. They can tell you what to include. Keep good records all year. This makes filing easier.

Boats and planes have their own rules. Values are set based on market data. The county looks at sales of similar items. Age and condition matter. Newer items have higher values. Well-kept items hold value longer. Make sure your return is accurate. False claims can lead to penalties.

Note: You are responsible for reporting all taxable personal property in DeKalb County, and failure to do so may result in penalties being assessed against you.

Nearby Counties

These counties border DeKalb County. Property tax rules may differ in each one. Check their websites for details if you own land nearby.

Additional Resources for DeKalb County Property Tax

These links provide more help with property tax matters in DeKalb County. Visit them for forms, online search tools, and state rules.

- DeKalb County Property Appraisal - Official assessment office website

- DeKalb County Tax Commissioner - Pay tax bills and view account online

- Georgia DOR DeKalb County Facts - State tax facts and data

- Georgia Taxpayers' Bill of Rights - Know your legal rights

- DeKalb County Government - Main county website

Note: The Board of Assessors is a five-member body of appointed citizens of DeKalb County, serving on a part time basis, who meet every other Thursday at 9:30 a.m.