Fulton County Property Tax Search

Fulton County property tax records are public documents. They show the assessed value of land and buildings in Atlanta and nearby areas. The county has over one million residents. It is the biggest county in Georgia. You can search these tax records online or visit an office in person. The Board of Tax Assessors sets property values. The Tax Commissioner sends tax bills and collects payments. Both offices serve the public from many locations across Fulton County.

Fulton County Property Tax Quick Facts

Fulton County Property Search Options

Fulton County offers many ways to search property tax records. You can look up assessments online at any time. The web tools are free to use. You can also visit an office during business hours. Staff can help you find what you need. Many people prefer online searches for speed. Others like in-person help for complex questions about their property.

The Fulton County Tax Assessor website lets you search by owner name, address, or parcel ID. This is the best place to start your search. You will find the current assessed value, property details, and sales history. The site also has a map view. This shows where the property sits in Fulton County. Visit fultonassessor.org to start your search.

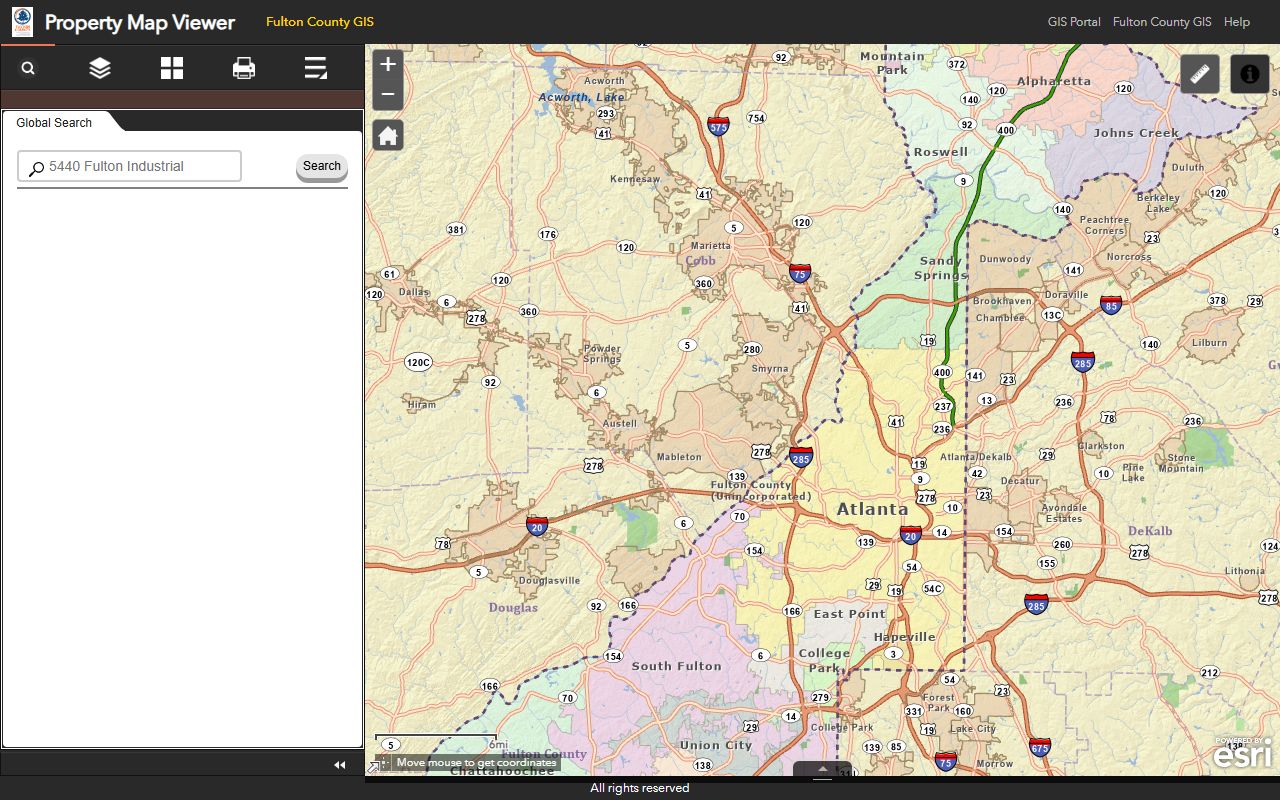

The Fulton County GIS Map Viewer is another great tool. It shows property lines and zoning. You can see flood zones and nearby parcels. This helps you understand the area around a property. The map works on phones and computers. Find it at gis.fultoncountyga.gov/Apps/PropertyMapViewer.

For tax bill info, use the Tax Commissioner website. This shows how much you owe and if payments are current. You can pay online with a card or bank draft. The site is at fultoncountytaxes.org. Both sites offer Fulton County property tax records at no cost to the public.

Fulton County Tax Assessor Office Information

The Fulton County Board of Tax Assessors values all real and personal property in the county. This office sets the fair market value for tax purposes. Georgia law says property must be assessed at 40% of fair market value. The chief appraiser leads this work. Staff review sales data and property traits each year. They mail assessment notices in the spring. These show your new value for the tax year.

The main office sits in downtown Atlanta. It is easy to reach by car or train. You can also use one of the branch offices spread across Fulton County. Each location offers the same basic services. Some have longer hours or more staff. Call ahead if you need special help. This saves time and ensures the right person is there.

| Main Office |

Fulton County Board of Tax Assessors 235 Peachtree Street, NE, Suite 1400 Atlanta, GA 30303 Phone: (404) 612-6440 Email: boa@fultoncountyga.gov |

|---|---|

| Chief Appraiser |

Calvin C. Hicks, Jr. Phone: (404) 371-2468 |

| Hours | Monday - Friday, 8:00 a.m. - 4:30 p.m. |

| Website | fultonassessor.org |

Branch offices help serve the large Fulton County area. The Fulton County Government Center is at 141 Pryor Street in Atlanta. The North Fulton Service Center is at 7741 Roswell Road. There is a Customer Service Center at Maxwell Road, 11575 Maxwell Road. The South Fulton Service Center sits at 5600 Stonewall Tell Road. The Greenbriar Mall Service Center is at 2841 Greenbriar Parkway. Each site handles property assessments and appeals for nearby residents.

Note: The Board of Assessors office only maintains information regarding property valuation for ad valorem tax purposes.

Fulton County Tax Commissioner Information

The Fulton County Tax Commissioner handles billing and collections. This office sends out tax bills each year. They also process payments and issue refunds. The Tax Commissioner works with the Sheriff on tax sales. They manage delinquent accounts too. For all tax billing questions, contact the Fulton County Tax Commissioner's Office.

Tax bills in Fulton County are usually due in the fall. The exact date can vary by year. Most bills are due by mid-December. You have 60 days from the postmark to pay before interest starts. Many people pay online for ease. You can also pay by mail or in person. The Tax Commissioner accepts checks, cards, and cash at most locations.

| Mailing Address |

P.O. Box 100127 Marietta, GA 30061-7027 |

|---|---|

| Phone | (404) 613-6100 |

| Website | fultoncountytaxes.org |

| Property Search | fultoncountytaxes.org/property-taxes.aspx |

Tax bill information should be requested from the Fulton County Tax Commissioner's office. This includes payment history, due dates, and amounts owed. The Tax Commissioner also handles motor vehicle tag renewals. Many people visit this office for both tax and tag needs. Check the website for current wait times and service hours.

How to Appeal Property Assessments in Fulton

Property owners in Fulton County can appeal their assessments. You have 45 days from the notice date to file. This deadline is strict. Missing it means you must wait until next year. Appeals must be based on specific grounds. Common reasons include value disputes or uniformity issues.

The first step is to file with the Fulton County Board of Tax Assessors. You can do this online or by mail. Include your property info and reason for appeal. Attach any proof you have. This might be sales of similar homes or an independent appraisal. The board will review your case. They may offer a settlement. If not, your case goes to the Board of Equalization.

Three appeal options exist in Georgia. You can choose the County Board of Equalization. This is a panel of citizens who hear cases. You can pick a Hearing Officer for complex cases. Or you can select an Arbitrator for a faster process. Each option has rules and time limits. Learn more at dor.georgia.gov/property-taxpayers-bill-rights.

If your final value is 85% or less of the original, you may recover costs. This includes fees and attorney costs. Keep all records of your appeal. Take notes during meetings. Georgia law lets you record talks with assessors. This protects your rights during the process in Fulton County.

Fulton County Homestead Exemptions

Homestead exemptions lower your tax bill in Fulton County. They remove part of your home's value from taxation. You must own and live in the home as of January 1. The standard state exemption takes $2,000 off your assessed value. Fulton County offers extra local exemptions too. These can save you much more money each year.

To qualify, file an application with the Tax Commissioner. The deadline is April 1. You only need to apply once. The exemption renews each year after that. Bring proof of ownership and residency. A driver's license and utility bill work well. Senior citizens may get extra exemptions based on age and income.

Fulton County has several special exemption programs. The basic homestead applies to all primary residences. Seniors over 65 may qualify for full school tax exemption. This is a major savings. Disabled veterans get extra benefits too. Each program has its own rules. Ask the Tax Commissioner which ones fit your situation.

You can apply online or in person. The process takes a few weeks. You will get a notice when approved. Your next tax bill will show the savings. For questions about exemptions, call the Tax Commissioner at (404) 613-6100. You can also visit fultoncountytaxes.org for forms and info.

Note: Copies of deeds and plats should be requested from the Fulton County Clerk of Superior and Magistrate Courts.

Cities in Fulton County

Fulton County includes the city of Atlanta and many other municipalities. All properties in these cities are assessed by the Fulton County Board of Tax Assessors. Tax bills come from the Fulton County Tax Commissioner. Each city may have its own rules about zoning and building permits. But property taxes are handled at the county level.

Other cities in Fulton County include Sandy Springs, Roswell, Johns Creek, Alpharetta, Milton, and East Point. All of these use the same Fulton County property tax records system for assessments and billing.

Nearby Counties

These counties border Fulton County. If you need property tax records for areas near Fulton, check these counties. Each has its own tax assessor and commissioner offices.