Property Tax Lookup for Jasper County and Monticello

Jasper County sits in the heart of Georgia. Monticello serves as the county seat. Property owners in Jasper County can access tax records through the county's online systems. The Board of Tax Assessors sets property values each year. The Tax Commissioner handles billing and collections. Together these offices maintain complete Jasper County property tax records. Residents and businesses can search assessments and pay taxes online or in person at the courthouse in Monticello.

Jasper County Tax Facts

Jasper County Tax Assessor Office

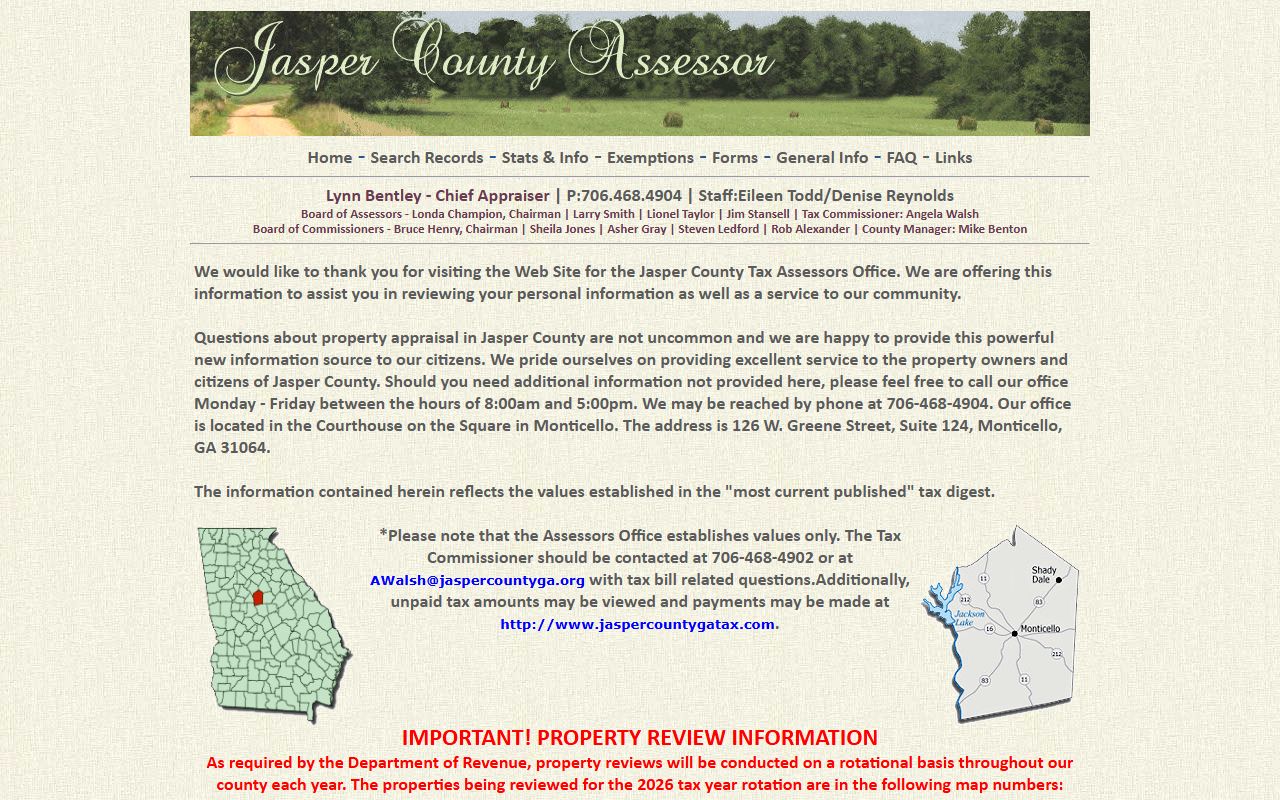

The Jasper County Board of Tax Assessors determines property values for all real and personal property in the county. This office does not collect taxes. Their role is to find the fair market value of each parcel. Georgia law requires assessed values to equal 40 percent of fair market value. The Jasper County Tax Assessor follows this rule for every property in the county.

The Tax Assessor office is located in Monticello at the courthouse. Staff are available Monday through Friday during regular business hours. You can call them at (706) 468-4904 with questions about property valuations. The office maintains records for all taxable property in Jasper County. This includes homes, farms, commercial buildings, and personal property like business equipment.

Jasper County uses QPublic.net for online property searches. This system lets you look up assessments from any computer or mobile device. You can search by owner name, property address, or parcel identification number. The search results show current assessed values, property details, and sales information. Visit qpublic.net/ga/jasper to access the online search tool.

The assessment process in Jasper County follows a regular cycle. Appraisers review property values each year. They use sales data from comparable properties to determine fair market value. Physical inspections occur on a rotating basis. Property owners receive assessment notices in the spring. These notices show the new assessed value and explain appeal rights.

| Office Location |

Jasper County Board of Tax Assessors 126 W Greene Street, Suite 132 Monticello, GA 31064 |

|---|---|

| Phone | (706) 468-4904 |

| Hours | Monday - Friday, 8:00 a.m. - 5:00 p.m. |

| Website | qpublic.net/ga/jasper |

Note: The Board of Tax Assessors office maintains property valuation information for ad valorem tax purposes only.

Jasper County Property Search Options

Jasper County offers convenient ways to search property tax records. The QPublic.net system provides free online access to assessment data. You can search by multiple criteria including owner name, street address, or parcel number. Results display instantly and include detailed property information.

The online search system shows land value and building value separately. You can see the total assessed value which equals 40 percent of fair market value. The system also displays property characteristics like square footage, year built, and lot size. Sales history helps you understand how values have changed over time.

Many Jasper County residents prefer online searches for convenience. The QPublic system works on computers, tablets, and smartphones. You can access records 24 hours a day without visiting an office. Print or save search results for your records. This is useful when preparing tax appeals or researching property values.

For those who prefer in-person assistance, the Tax Assessor office in Monticello welcomes visitors. Staff can help with complex searches or explain assessment details. The office has public access computers for online searches. Paper maps and records are available for older properties. Call ahead to confirm office hours before visiting.

Visit the Georgia Department of Revenue for county tax facts at dor.georgia.gov/county-property-tax-facts. This page provides additional information about property taxes in Jasper County and throughout Georgia.

Jasper County Property Assessment Process

Property assessments in Jasper County follow Georgia state law. The Board of Tax Assessors must determine fair market value for every taxable property. Fair market value means the price a willing buyer would pay a willing seller. This value forms the basis for property taxation in Jasper County.

The assessment ratio in Georgia is fixed at 40 percent. This means your assessed value equals 40 percent of fair market value. For example, if your home has a fair market value of $150,000, your assessed value would be $60,000. Tax rates apply to this assessed value to calculate your tax bill.

Jasper County appraisers use several methods to determine value. The sales comparison approach looks at recent sales of similar properties. The cost approach calculates what it would take to replace the building. The income approach applies to rental properties. Appraisers choose the best method for each property type.

Assessment notices are mailed each spring to all property owners. The notice shows last year's value and the new assessed value. It explains your right to appeal if you disagree with the valuation. You have 45 days from the notice date to file an appeal. This deadline is strict and cannot be extended.

The appeal process in Jasper County offers several options. You can appeal to the County Board of Equalization. This citizen panel hears disputes between taxpayers and the assessor. You may also choose a hearing officer or binding arbitration. Each option has specific procedures and timelines. Learn more about taxpayer rights at dor.georgia.gov/property-taxpayers-bill-rights.

Evidence is important for successful appeals. Gather recent sales of comparable properties in your area. Document any property defects that reduce value. Professional appraisals can support your case. Present clear, organized information at your hearing. The board will review your evidence and issue a decision.

Paying Jasper County Property Taxes

The Jasper County Tax Commissioner handles property tax billing and collections. Tax bills are based on the assessed values set by the Board of Tax Assessors. Bills are mailed to property owners each fall. The exact due date varies but is typically in December. Property owners should mark their calendars to avoid late penalties.

Jasper County offers multiple ways to pay property taxes. Online payment is available through the county website. You can pay with credit card, debit card, or electronic check. Some convenience fees may apply for card payments. Paying by mail is another option. Send your check with the payment stub to the Tax Commissioner address.

In-person payments are accepted at the courthouse in Monticello. The Tax Commissioner office accepts cash, check, money order, and cards. Office hours are Monday through Friday during business hours. The office closes for state holidays. Bring your tax bill or parcel number to ensure proper credit.

Property tax bills in Jasper County include taxes for multiple purposes. The county government receives a portion for general operations. The school district receives funds for education. Some areas may also have municipal taxes if located within city limits. Each taxing authority sets its own millage rate annually.

Homestead exemptions can reduce your Jasper County tax bill. The standard state exemption removes $2,000 from your assessed value. You must own and occupy the property as your primary residence. Applications are due by April 1 of the tax year. File with the Tax Commissioner in Monticello. Once approved, the exemption renews automatically each year.

Late payments accrue interest and penalties. The Tax Commissioner may initiate collection actions for delinquent taxes. This can include tax liens or tax sales in severe cases. Contact the Tax Commissioner office immediately if you cannot pay on time. Payment plans may be available for taxpayers who communicate early.

Nearby Counties Property Tax Records

Jasper County borders several other Georgia counties. Property owners near county boundaries should verify which county handles their taxes. Each county maintains separate records and uses different systems. The following counties neighbor Jasper County:

Additional Resources

These official websites provide more information about property taxes in Jasper County and throughout Georgia. Use these resources for forms, payment options, and detailed tax information.

Jasper County QPublic - Online property search and assessment records

Georgia DOR County Property Tax Facts - State tax information organized by county

Georgia Property Taxpayer's Bill of Rights - Appeal rights and taxpayer protections