Meriwether County Property Tax Assessment and Record Search

Meriwether County is located in west-central Georgia with Greenville serving as the county seat. The county is known for its rich agricultural heritage and picturesque landscapes. Property tax records in Meriwether County are maintained by the Tax Assessor's Office, which provides public access to property valuations, ownership details, and assessment information. Residents and property owners can access these records online through the QPublic portal or by visiting the assessor's office in Greenville.

QPublic Online Property Records System

Meriwether County utilizes the QPublic.net platform for online property record access. This comprehensive system allows property owners, real estate professionals, and the general public to search for property information from any internet-connected device. The QPublic portal provides detailed parcel data including ownership history, assessed values, property characteristics, and tax information.

The online database is updated regularly to ensure accuracy. Users can search by owner name, property address, or parcel identification number. The system displays property maps, aerial photography, and detailed assessment data. This transparency helps property owners understand their valuations and enables informed decision-making for potential buyers.

To access Meriwether County property records online, visit qpublic.net/ga/meriwether. The website offers various search options to help users locate specific properties. No registration is required for basic property searches. The system is available 24 hours a day, providing convenient access to public records whenever needed.

| Online Portal | qpublic.net/ga/meriwether |

|---|---|

| Search Options | Owner name, property address, parcel number, or map location |

| Availability | 24/7 online access |

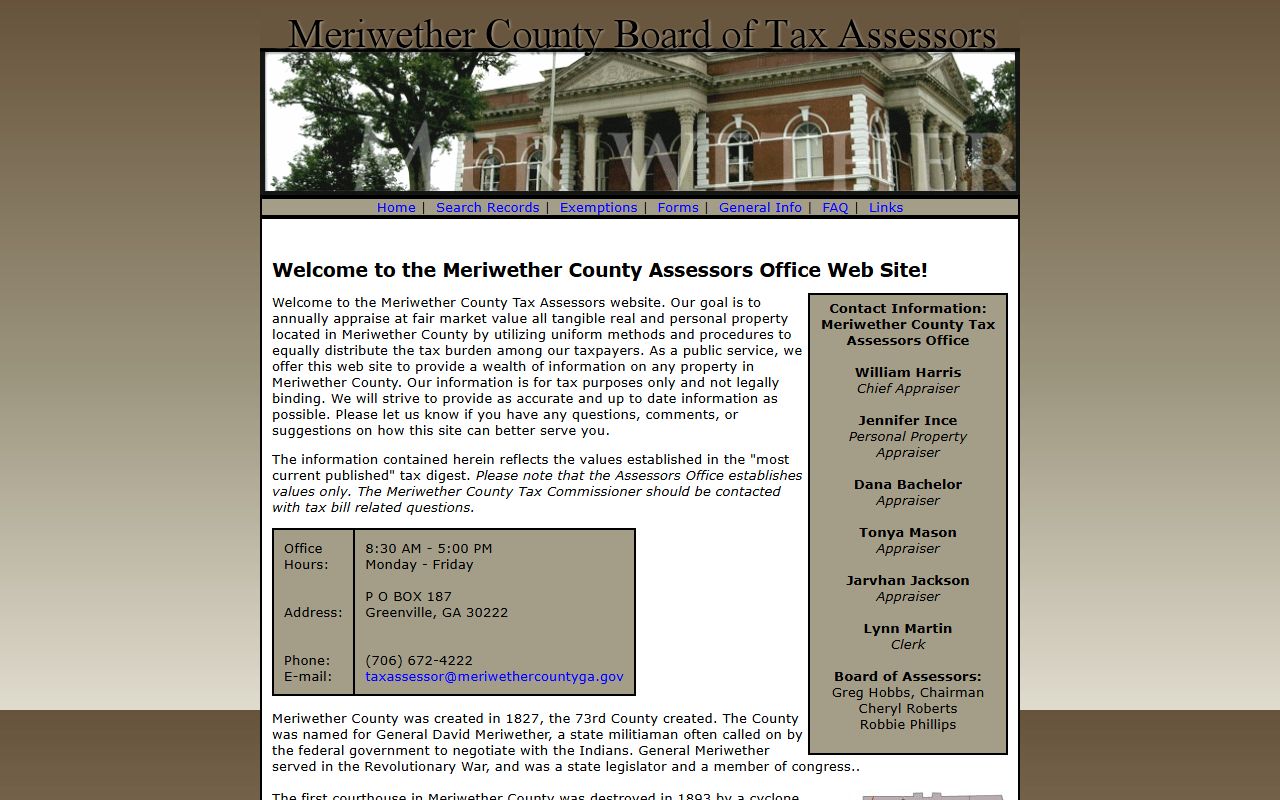

Meriwether County Tax Assessor Office

The Meriwether County Tax Assessor is responsible for determining the fair market value of all taxable property within the county. This office maintains detailed records on approximately 15,000 parcels of real property and numerous personal property accounts. Staff work diligently to ensure assessments reflect current market conditions while complying with Georgia state assessment laws and regulations.

The assessment process involves analyzing sales data, inspecting properties, and applying standardized valuation methods. Residential properties are typically assessed based on comparable sales in the area. Commercial and agricultural properties may require more complex valuation approaches. The assessor's office aims to achieve uniformity and equity across all property types.

Property owners who disagree with their assessments have the right to appeal. The appeal process begins with informal discussions with assessment staff. If unresolved, formal appeals can be filed with the Board of Equalization. The Georgia Department of Revenue provides oversight to ensure the appeal process follows state guidelines.

| Office Address |

173 N. Court Square Greenville, GA 30222 |

|---|---|

| Office Hours | Monday through Friday, 8:00 AM to 5:00 PM |

| Phone | Contact through main county line |

The Tax Assessor's Office is located in the historic courthouse area of Greenville. Staff are available to assist with property searches, answer valuation questions, and provide information about available exemptions. Property owners are encouraged to visit the office if they need assistance understanding their assessments.

Understanding Property Tax Assessments in Meriwether County

Property taxes in Georgia are based on the assessed value of real and personal property. The assessment process begins with the Tax Assessor determining the fair market value of each property. This value represents the price a willing buyer would pay a willing seller in an arm's length transaction. Assessments are conducted annually to reflect changes in the real estate market.

Once the assessed value is established, it is multiplied by the assessment ratio to determine the taxable value. Residential properties are assessed at 40% of fair market value. Commercial and industrial properties are also assessed at 40%. Agricultural properties may qualify for preferential assessment based on current use rather than market value.

Tax bills are calculated by applying the millage rate to the taxable value. The millage rate is set annually by the Meriwether County Board of Commissioners, the Meriwether County Board of Education, and any applicable city councils. These rates fund essential government services including schools, public safety, roads, and other county operations.

Property owners receive assessment notices each year, typically in the spring. These notices indicate the proposed assessed value for the upcoming tax year. It is important to review these notices carefully, as they provide the opportunity to appeal if the assessed value appears incorrect. The appeal window is limited, so prompt action is necessary if you wish to contest your assessment.

Property Tax Exemptions Available in Meriwether County

Georgia law provides several property tax exemptions that can reduce the tax burden for qualifying property owners in Meriwether County. The most common exemption is the standard homestead exemption, available to homeowners who occupy their property as their primary residence. This exemption exempts a portion of the home's assessed value from taxation.

Senior citizens may qualify for additional exemptions based on age and income. The standard senior exemption provides greater tax relief for homeowners aged 65 and older. Some exemptions require meeting specific income thresholds, while others are available regardless of income. Disabled veterans and surviving spouses may also qualify for special exemptions.

To claim exemptions, property owners must file an application with the Tax Assessor's Office. Applications for homestead exemptions are typically due by April 1st of the tax year. Once approved, most exemptions renew automatically as long as the property remains eligible. However, changes in ownership or use may require filing a new application.

The Tax Assessor's Office can provide detailed information about available exemptions and application requirements. Property owners should inquire about all exemptions for which they may qualify, as these can result in significant tax savings. Exemptions are an important tool for making property taxes more affordable for residents.

Greenville: County Seat of Meriwether County

Greenville serves as the county seat and administrative center for Meriwether County. This historic city hosts the county government offices, including the Tax Assessor and Tax Commissioner offices. The courthouse and related facilities are located in the heart of Greenville, making it convenient for residents to conduct county business.

The downtown Greenville area features the historic courthouse and surrounding government buildings. Property owners from throughout Meriwether County travel to Greenville to handle tax matters, attend court proceedings, and access other county services. The city's central location within the county makes it accessible from all directions.

Greenville itself contains numerous taxable properties, from historic homes to commercial establishments. Properties within the city limits may be subject to municipal taxes in addition to county taxes. Property owners should be aware of the various taxing authorities that may apply to their specific location within Meriwether County.

Related Areas

Meriwether County is located in west-central Georgia and shares borders with several other counties. Property owners in the area may need to access records from neighboring jurisdictions for various purposes. The following nearby counties offer similar property tax record services through their respective assessor offices.

Additional Resources

The following resources provide additional information about property taxes in Meriwether County and throughout Georgia. These official sources can help property owners understand their rights and responsibilities regarding property taxation.

QPublic Meriwether County - Online property records search portal

Georgia Department of Revenue - County Property Tax Facts - Statewide property tax information

Georgia Property Taxpayers' Bill of Rights - Understanding your rights as a taxpayer