Harris County Property Tax Lookup and Assessment Guide

Harris County sits in the western part of Georgia. Hamilton serves as the county seat. The county has a mix of rural land and small towns. Property owners here pay taxes based on assessed values. The Tax Assessor sets these values each year. Tax bills go out in the fall. Records are public. Anyone can search them. The QPublic.net system hosts the online database. This makes finding property data fast and easy.

Harris County Property Tax Quick Facts

Harris County Property Search Options

Harris County offers online tools for property searches. The main portal is QPublic.net. This site hosts data for many Georgia counties. Harris County uses this shared platform. It keeps costs low for taxpayers. The site is free to use. No login is needed.

You can search by owner name on QPublic.net. Enter the last name first. Then add the first name. The system will show matching records. You can also search by parcel ID. This number is unique to each property. It stays the same even when owners change. The parcel ID appears on tax bills and deeds.

Address searches work well too. Type in the street number and name. The site will show all parcels on that road. This helps when you know the location but not the owner. Map views show where parcels sit. You can zoom in and out. The map shows property lines.

Visit www.qpublic.net/ga/harris/ to start your search. This page has links to real property and personal property data. Personal property includes business equipment and vehicles. Real property covers land and buildings. Both types use the same search tools.

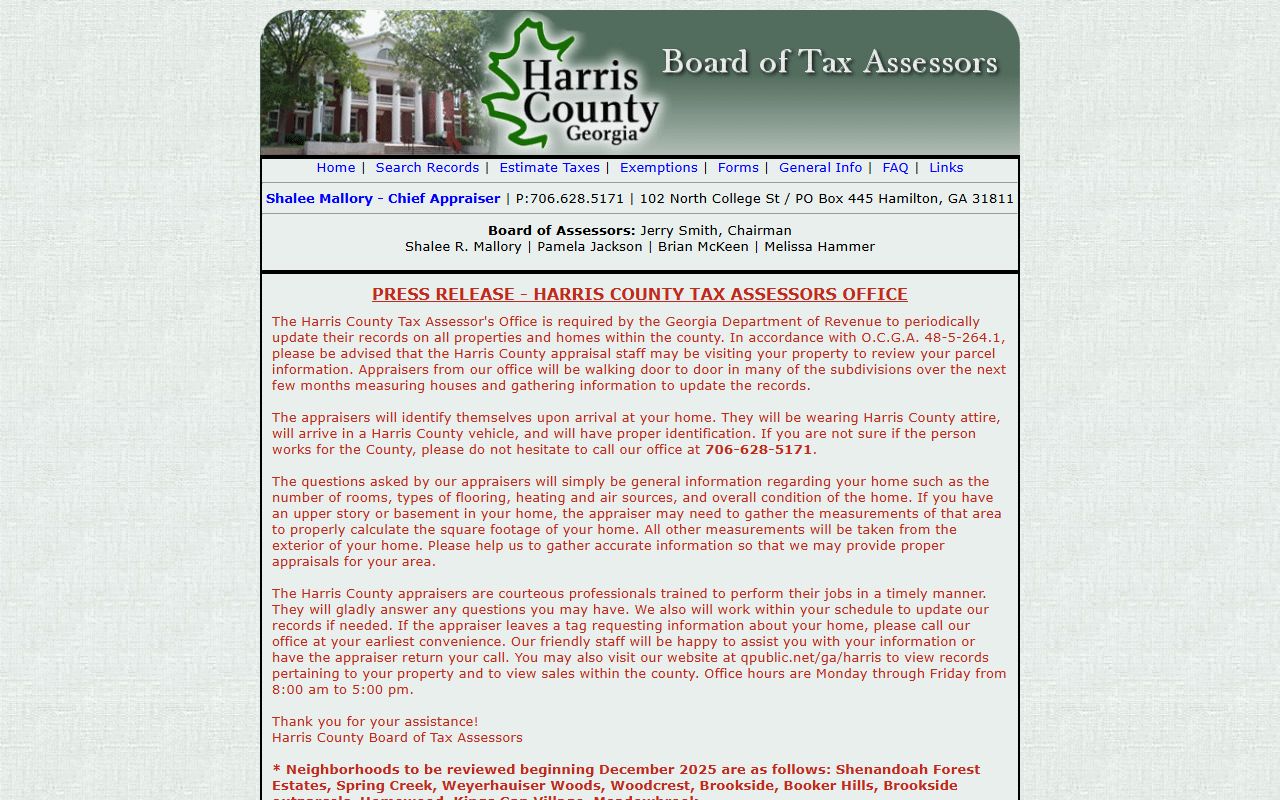

Harris County Tax Assessor Office Information

The Harris County Tax Assessor values all property in the county. This includes homes, farms, and businesses. Georgia law sets the rules. Property must be assessed at 40% of fair market value. This is called the assessed value. Tax rates apply to this number. Not to the full market price.

Staff visit properties to check their condition. They note any changes. New buildings raise the value. Damage lowers it. Sales of nearby homes also affect values. The assessor tracks these trends. Values change each year. Notices go out in the spring.

The main office is in Hamilton. This is the county seat. It sits near the center of Harris County. You can drive there from any part of the county within an hour. Office hours are weekdays from 8:00 a.m. to 5:00 p.m. Staff can help with searches. They can explain the process. They can answer questions about your assessment.

| Office |

Harris County Tax Assessor 104 N College St Hamilton, GA 31811 |

|---|---|

| Phone | (706) 628-5171 |

| Fax | (706) 628-5129 |

| Hours | Monday - Friday, 8:00 a.m. - 5:00 p.m. |

| Website | www.qpublic.net/ga/harris/ |

The Tax Assessor handles appeals too. You can file if you think your value is wrong. The deadline is strict. You have 45 days from the notice date. Missing this date means you wait a full year. File on time to protect your rights.

Harris County Tax Commissioner Information

The Tax Commissioner sends out tax bills. They collect the payments too. This office is separate from the Assessor. The Assessor sets the value. The Commissioner handles the money. Both work to serve Harris County taxpayers.

Tax bills in Harris County go out in the fall. The due date varies by year. Most fall in December. You can pay online with a card. You can pay by mail with a check. You can pay in person with cash. The office accepts many payment types.

Late payments earn interest. The rate is set by state law. It changes each year. Check your bill for the current rate. Penalties may apply too. Pay on time to avoid extra costs. If you cannot pay in full, contact the office. They may offer a payment plan.

The Tax Commissioner also handles mobile home decals. These must be renewed each year. The office issues business licenses too. Many people visit for multiple needs. Call ahead to ask what to bring. This saves time and trips.

For tax bill questions, contact the Tax Commissioner. For value questions, contact the Assessor. Each office has its own role. Visit the Georgia Department of Revenue site for county tax facts at dor.georgia.gov/county-property-tax-facts. This page lists rates and deadlines for all Georgia counties.

How to Appeal Property Assessments in Harris County

Property owners can appeal their assessments. This is your right under Georgia law. The process starts when you get your notice. Look at the assessed value. Compare it to recent sales. Check if it seems fair.

You have 45 days to file an appeal. The notice shows this date clearly. Do not miss it. File even if you are not sure. You can withdraw later. But you cannot file late. The form is simple. You can get it from the Assessor's office.

Three appeal paths exist in Georgia. You can pick the Board of Equalization. This is a panel of local citizens. They hear your case and decide. You can choose a Hearing Officer. This person has training in property law. You can select Binding Arbitration. This is faster but has some limits.

Gather proof for your appeal. Find sales of similar homes. These should be close to your area. They should be recent. Within the past year is best. Photos help too. Show any damage or issues. An appraisal from a pro adds weight. But it costs money.

The Assessor may meet with you first. This is informal. Bring your evidence. Explain your view. They may agree to lower the value. If not, your case moves forward. Learn more about taxpayer rights at dor.georgia.gov/property-taxpayers-bill-rights. This page explains each step in detail.

Harris County Homestead Exemptions

Homestead exemptions lower your tax bill. They remove part of your home's value from taxes. You must own and live in the home. The deadline is January 1. You must stay all year. File by April 1 to claim it.

The standard state exemption is $2,000. This comes off your assessed value. Harris County may offer more. Check with the Tax Commissioner. Seniors over 65 may get extra. Disabled vets get special breaks. Each group has forms to file.

You only apply once. The exemption renews each year. But you must tell them if you move. You must report if you rent the home out. False claims bring penalties. Be honest about your status.

To apply, bring proof of ownership. A deed works well. Bring proof you live there. A driver's license with that address is good. A utility bill helps too. The office may ask for more. Call before you go. Ask what to bring.

Exemptions save real money. On a $200,000 home, the standard exemption saves about $100 or more. This depends on the tax rate. Senior exemptions save even more. File on time to get the full benefit.

Cities in Harris County

Harris County includes several incorporated areas. The county seat is Hamilton. It is the largest town. Other cities include Pine Mountain, Shiloh, and Waverly Hall. Each has its own city council. But property taxes are set by the county.

These cities use the same Harris County property tax system. All assessments come from the county Tax Assessor. All bills come from the county Tax Commissioner.

Nearby Counties

These counties border Harris County. If you need records for areas nearby, check these counties. Each has its own tax offices.